Authorization Rates: A Complete Guide for Businesses

Understand authorization rates and their impact on your business. Learn how to calculate, improve, and monitor them for better customer satisfaction and revenue.

In the world of online payments, every second counts. Customers expect a smooth and secure checkout experience, and any hiccup along the way can send them running to your competitors. One of the most critical—yet often overlooked—aspects of payment processing is your authorization rate. This metric, which reflects the percentage of approved transactions, can make or break your business's success. Low authorization rates can lead to lost revenue, frustrated customers, and a damaged brand reputation. Ready to unlock the secrets to higher authorization rates and keep those sales rolling in? Let's explore the factors that influence authorization rates and the strategies you can implement to optimize your payment processing flow.

Key Takeaways

Don't let declined payments hurt your bottom line: A high authorization rate is directly linked to increased revenue and customer satisfaction.

Take a close look at what's causing those declined transactions: Are outdated customer card details to blame? Or perhaps overly aggressive fraud filters? Identifying the root causes is the first step to improvement.

A seamless checkout experience is key: Make it easy for your customers to pay by offering multiple payment options, streamlining your checkout process, and ensuring your website is secure and trustworthy.

What Are Authorization Rates?

Definition and Importance

In the simplest terms, authorization rates are the percentage of approved transactions out of all attempted transactions. Think of it as a report card for your payment processing system. A high authorization rate signals a smooth and efficient process, leading to more happy customers and increased revenue.

When a customer makes a purchase, their bank needs to authorize the transaction before funds are transferred. A declined transaction can mean a lost sale and a frustrated customer. PayPal emphasizes the importance of high authorization rates for businesses, linking them to increased customer retention and revenue growth.

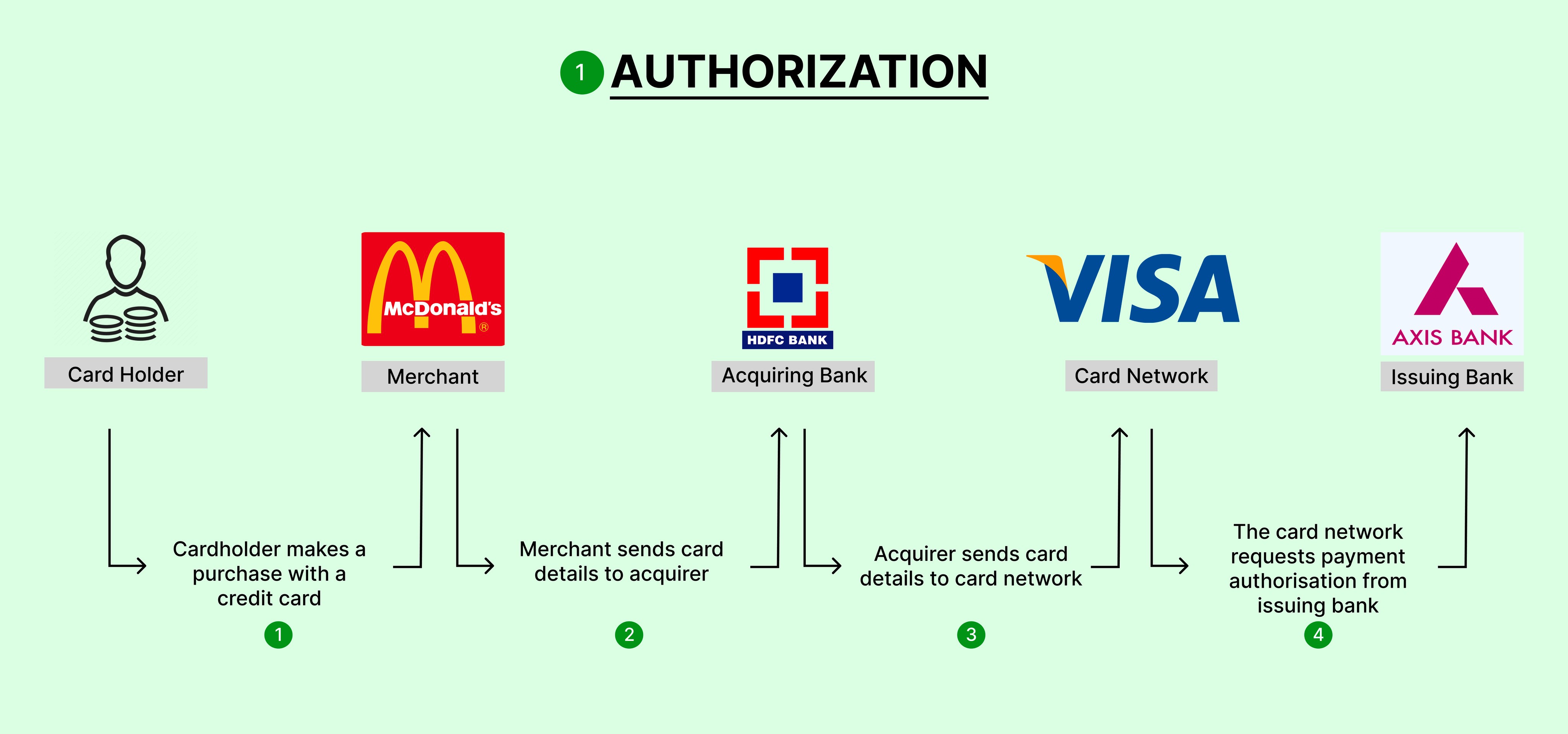

Authorization Rates and Payment Processing

Your authorization rates are directly tied to the effectiveness of your payment processing system. As Global Payments points out, achieving a perfect 100% authorization rate is nearly impossible, especially for businesses processing a high volume of transactions. However, by understanding the factors that influence these rates, you can make informed decisions to improve your payment processing and create a better experience for your customers. Analyzing declined transactions can reveal patterns and issues, allowing you to fine-tune your processes and minimize future declines.

Calculate Your Authorization Rates

Knowing where you stand is the first step toward improvement. Calculating your authorization rate is a simple process.

The Formula Explained

To determine your authorization rate, follow this straightforward formula:

Gather data: Collect the total number of approved transactions and the total number of attempted transactions (including both approved and declined ones).

Apply the formula: Divide the number of approved transactions by the total number of attempted transactions.

Calculate the percentage: Multiply the result by 100 to express your authorization rate as a percentage.

Interpreting Your Results

Your authorization rate is a key indicator of the health of your payment processing. While achieving a 100% authorization rate is nearly impossible, a high rate generally suggests a healthy payment process.

A low authorization rate, however, can signal underlying issues that require attention. By analyzing declined transactions, you can pinpoint problem areas within your payment process. For example, you might uncover recurring errors, outdated customer card information, or even overly aggressive fraud filters. Contact our sales team to learn how we can help you analyze your authorization rates and identify areas for improvement.

Why Authorization Rates Matter

Let’s be real: nobody enjoys getting a payment declined. It’s inconvenient for your customers, and for you, it means a lost sale. High authorization rates are a fundamental indicator of a healthy business, especially in our digital world. Let's explore why.

Impact on Revenue and Customer Satisfaction

Think about the last time you had a payment declined while shopping online. Did you try again right away, or did you abandon your cart and maybe even shop with a competitor? A high authorization rate directly correlates with a higher likelihood of repeat business and increased revenue. Conversely, consistently low authorization rates can lead to lost revenue and, just as importantly, customer frustration.

Overall Business Performance

Beyond the immediate impact on sales, your authorization rates provide valuable insights into the efficiency of your payment processing systems. High rates generally indicate a smooth and reliable transaction process, which is essential for any successful business, especially those operating predominantly online. By optimizing authorization rates, you can significantly impact both your revenue and customer satisfaction, creating a win-win situation for your business.

Common Causes of Low Authorization Rates

Let’s face it: a declined payment can be frustrating for everyone. For businesses, a high volume of declined payments can indicate deeper issues with your payment processing systems. At Edge, we understand the importance of seamless transactions. Let's explore some of the most common culprits behind low authorization rates and how to address them:

Payment Processing Errors

Technical glitches happen, and even a small error in your payment processing system can lead to declined transactions. Think of it like a tiny snag in a smooth silk fabric – it disrupts the entire flow. These errors can stem from incorrect data entry, network connectivity issues, or problems with your payment gateway. Ensuring your systems are regularly maintained and updated can minimize these errors.

Outdated Payment Information

We’ve all been there – you're excited to make a purchase, but your card gets declined because the expiration date has passed. It's a common scenario for recurring payments, like subscriptions, where stored card details might be outdated. PayPal highlights this as a major contributor to low authorization rates. Implementing a system that automatically updates customer card information can significantly reduce these types of declines.

Fraud Detection Challenges

In an effort to combat fraud, sometimes legitimate transactions get flagged. It’s like having a super-sensitive smoke alarm that goes off when you’re just making toast. Overly strict fraud filters can mistakenly decline legitimate transactions, impacting your authorization rates and customer experience. Adyen emphasizes the importance of finding the right balance in fraud prevention to avoid hurting your authorization rates. Regularly reviewing and fine-tuning your fraud filters can help you strike that balance.

Unsupported Payment Methods

In today's diverse market, customers prefer options. Limiting your payment methods to just a few can lead to missed opportunities. Imagine walking into a store that only accepts cash – you might not always have it on hand. Payment Genes notes that understanding the usage and authorization rates of different payment methods is crucial. Offering a wider range of payment options, including digital wallets and international cards, can cater to a broader customer base and potentially increase your authorization rates.

Improve Your Authorization Rates

Let’s face it: a declined payment is disappointing for everyone. For your customers, it’s a frustrating experience that can lead them to abandon their carts. For you, it means a lost sale and potentially damaged customer relationships.

The good news? You can take steps to prevent these situations. Here’s how to improve authorization rates and create a smoother experience for your customers:

Implement Automatic Retry Mechanisms

Sometimes, transactions fail for reasons outside of your control or your customer’s control—think temporary network issues or bank server outages. An automatic retry mechanism can help recover these transactions by resubmitting them after a predetermined delay. This gives the issuing bank another chance to approve the payment without any extra effort from your customer.

Primer suggests using an adaptive retry system to analyze failures and determine the optimal retry times, maximizing your chances of success.

Optimize Fraud Detection Settings

While robust fraud detection is crucial, overly strict settings can lead to false declines, blocking legitimate transactions. It’s a delicate balancing act. Review your fraud filters regularly and fine-tune them to target truly fraudulent transactions. By striking the right balance, you can minimize false declines and avoid inconveniencing good customers.

Offer Multiple Payment Options

The payment landscape is constantly evolving, and consumer preferences are shifting right along with it. Offering a diverse range of payment options, including credit and debit cards, digital wallets like PayPal and Venmo, buy now, pay later options, and even local payment methods, can significantly impact your authorization rates. Providing a variety of familiar payment methods caters to a wider audience and reduces cart abandonment.

Keep Customer Payment Information Current

Expired credit card information is a common culprit behind declined payments. Implementing a system that automatically updates stored card details can help you avoid these preventable declines. Consider using a real-time account updater, a service that works behind the scenes to keep customer card information current.

Enhance Checkout Experience

A seamless and user-friendly checkout experience is essential for securing approvals. A confusing or lengthy checkout process can lead to frustration and abandoned carts. Make sure your checkout page is easy to navigate, with a clear and logical flow. Minimize the number of steps required to complete a purchase, and ensure that important information, like card details and CVV numbers, is clearly visible.

Tools for Monitoring Authorization Rates

Knowing your authorization rates is the first step. Next, you need the right tools to help you improve. Let's look at some options:

Enhanced Issuer Networks

Enhanced issuer networks offer a way to improve authorization rates. For example, Stripe's Enhanced Issuer Network uses advanced algorithms and data analytics to optimize transaction approvals. This leads to a smoother process and can result in a significant increase in authorization rates for businesses using the platform.

3D Secure 2 (3DS2)

3D Secure 2 (3DS2) adds another layer of security during online transactions. This technology helps reduce fraud and gives customers more confidence in the payment process. By using risk-based authentication, 3DS2 minimizes unnecessary friction during checkout, leading to higher authorization rates.

Adaptive Retry Systems

Sometimes transactions are declined for reasons unrelated to the customer or their card. Adaptive retry systems can help recover these potentially lost sales. These systems analyze failed transactions and use historical data to determine the optimal time to retry the payment.

Real-Time Account Updaters

Expired or outdated card information is a common reason for declined transactions. Real-time account updaters, like the one offered by PayPal, automatically update stored customer card details. This ensures you always have the most current payment information, leading to a smoother checkout experience and higher authorization rates.

Balance Fraud Prevention and Authorization Rates

Let’s face it: no one wants to lose money. And in the world of online payments, fraud prevention is non-negotiable. But here’s the catch – overly aggressive fraud prevention can block legitimate transactions, leading to frustrated customers and lost revenue.

So, how do you find the sweet spot? It’s all about striking a balance. As experts note, "chargeback rate and overall authorization rate impact are crucial metrics that directly reflect the effectiveness of fraud prevention measures."

Advanced Fraud Management Tools

Think of fraud management tools as your business’s secret weapon. Sophisticated tools go beyond basic security checks, using machine learning and data analysis to assess risk more effectively. This means you can approve more legitimate transactions while keeping fraudulent ones at bay.

Investing in the right tools is key. Look for features like:

Real-time transaction monitoring: Catch suspicious activity as it happens.

Behavioral analytics: Identify unusual patterns that might indicate fraud.

Customizable risk rules: Tailor your fraud prevention strategy to your business needs.

Minimize False Declines

False declines – those frustrating moments when a legitimate customer is wrongly flagged as fraudulent – are a major pain point for businesses. They lead to lost sales and can damage your brand reputation. Experts acknowledge that "having zero card-not-present (CNP) declines—or a 100% authorization rate—is nearly impossible," but understanding why they happen is the first step to minimizing them.

Sometimes it’s a simple data entry error, other times it might be a mismatch between the customer’s billing and shipping address. Analyzing transactions that weren't approved helps identify issues in the payment process and ultimately, improve your authorization rates.

Here are a few ways to reduce false declines:

Implement address verification systems (AVS): Verify customer addresses to prevent mismatches.

Use card verification value (CVV) checks: Add an extra layer of security to card-not-present transactions.

Offer alternative payment methods: Give customers more options to complete their purchases.

Remember, finding the right balance between fraud prevention and authorization rates is an ongoing process. Regularly review your fraud management strategies and make adjustments as needed to optimize your payment processing flow.

Industry Benchmarks and Best Practices

Even with the best systems in place, you won't be able to approve every transaction. Focusing on industry standards and proven tactics can help you move in the right direction.

Set Realistic Goals

It's tempting to aim for a perfect 100% authorization rate. However, a zero-decline scenario is unlikely, especially if your business processes a high volume of transactions. Card-not-present transactions naturally come with more risk, making it essential to have achievable goals.

Track Metrics for Optimization

To improve your authorization rates, you need to know where you stand. Regularly calculating your authorization rate, and comparing it against industry averages, helps you understand your baseline.

Think about it like this: you wouldn't try to improve a recipe without tasting it first, right? Keep a close eye on these key metrics:

Authorization rates for different payment methods: Do you notice differences between Visa and American Express, for example? This data can reveal opportunities to optimize your payment processing for specific card types.

Chargeback rate: A high chargeback rate can indicate underlying issues that also impact authorizations. By addressing the root causes of chargebacks, you can often improve your authorization rates simultaneously.

Overall authorization rate: This number gives you a bird's-eye view of your performance. Track it over time to identify trends and measure the impact of any changes you make.

Benchmarking your payment data against others in your industry helps you identify areas for improvement and make more strategic decisions about your payment processing setup.

The Future of Authorization Rates

We live in a world of instant gratification. Customers expect seamless and secure transactions, making authorization rates more critical than ever. Let's explore the trends shaping the future of authorization rates:

Emerging Technologies in Payment Processing

The payments landscape is constantly evolving, with new technologies emerging to improve security and streamline transactions. Here are a few to keep on your radar:

Tokenization: Remember how network tokenization works? It replaces sensitive card data with unique tokens, reducing the risk of fraud and improving authorization rates.

Biometric Authentication: Fingerprint scanning and facial recognition add extra layers of security, minimizing fraudulent transactions and making customers feel more secure.

Artificial Intelligence (AI) and Machine Learning (ML): AI and ML can analyze transaction data in real-time to identify and prevent fraud, leading to more accurate risk assessments and higher approval rates.

Adapting to Changing Consumer Behaviors

Consumer behavior plays a significant role in authorization rates. As customers embrace new payment methods and prioritize security, businesses need to adapt:

Mobile Wallets and Digital Payments: The increasing use of mobile wallets and digital payment platforms requires businesses to ensure their payment systems integrate seamlessly with these technologies.

Increased Security Concerns: Customers are more aware of data security than ever. Clearly communicate your security measures and use trusted payment gateways to build trust and encourage transactions.

Demand for Alternative Payment Methods: Offering a variety of payment options, such as buy now, pay later services, can cater to diverse preferences and potentially improve authorization rates.

By staying informed about these emerging technologies and adapting to changing consumer behaviors, businesses can create a more frictionless and secure payment experience, ultimately leading to higher authorization rates and increased revenue.

Related Articles

Improve Payment Authorization Without Losing Security - Edge

How Payment Processing Works: Unlocking the Secrets to Secure and Efficient Transactions - Edge

Future Trends in High-Risk Payment Processing You Should Know - Edge

Mastering Payment Metrics: Unlocking Insights to Drive Business Success - Edge

Increase Your Payment Acceptance Rates Using Data Analysis - Edge

Frequently Asked Questions

What should I do if my authorization rates are consistently low?

Don't panic! It's common to experience fluctuations in authorization rates. Start by analyzing your declined transactions to identify any patterns or recurring issues. Look for things like frequently declined card types, common error messages, or a high volume of transactions failing during specific times. Once you've pinpointed potential problem areas, you can take targeted steps to address them, such as updating your fraud filters, improving your checkout process, or exploring alternative payment gateways.

How can I prevent fraudulent transactions without negatively impacting my authorization rates?

It's a balancing act, but it's achievable. Implement a multi-layered approach to fraud prevention that combines robust security measures with a customer-centric approach. Utilize address verification systems (AVS) and card verification value (CVV) checks to validate transactions without introducing unnecessary friction. Consider implementing a system that flags suspicious transactions for manual review, allowing you to catch potential fraud without automatically declining legitimate purchases.

What are some common mistakes businesses make that can hurt their authorization rates?

One common mistake is neglecting to keep customer payment information up to date. Expired credit card details are a major culprit behind declined transactions. Implementing a system that automatically updates stored card information can significantly reduce these preventable declines. Another mistake is offering limited payment options. In today's diverse market, customers appreciate flexibility. Restricting payment methods can lead to missed opportunities and frustrated customers.

How often should I review and update my fraud prevention strategies?

The digital landscape is constantly evolving, and so are the tactics used by fraudsters. It's essential to review your fraud prevention strategies regularly – at least quarterly, or even more frequently if your business operates in a high-risk industry. Keep an eye on industry trends, security updates, and emerging fraud patterns to ensure your strategies remain effective.

What role does customer experience play in authorization rates?

A smooth and user-friendly checkout experience is crucial for securing approvals. A confusing or lengthy checkout process can lead to frustration and abandoned carts, ultimately impacting your authorization rates. Prioritize a seamless checkout flow, clear communication, and a mobile-friendly design to create a positive experience for your customers and increase the likelihood of successful transactions.

© 2025 Edge Payment Technologies, Inc.

6600 Sunset Blvd. Ste. 226 Los Angeles, CA. 90028

(323)-388-3931

Registered ISO of FFB Bank and Chesapeake Bank