Recent posts

Crafting Value Propositions That Convert

Secure E-commerce Purchases: A Guide to Fraud Detection Software

Get Your Business Loan Approved: A Step-by-Step Guide

Secure Banking: Best Practices to Prevent Identity Theft

How to Secure Peer-to-Peer Payments with Encryption

How to Pay Employees: A Small Business Guide

Securing Cryptocurrency Exchanges: How to Use Encryption

Understanding Up-Front Bonuses in Payment Processing

Secure Bank Transfers: Using Two-Factor Authentication

How to Use Firewalls to Secure Credit Card Transactions

Secure Stock Trades: Using Multi-Signature Wallets

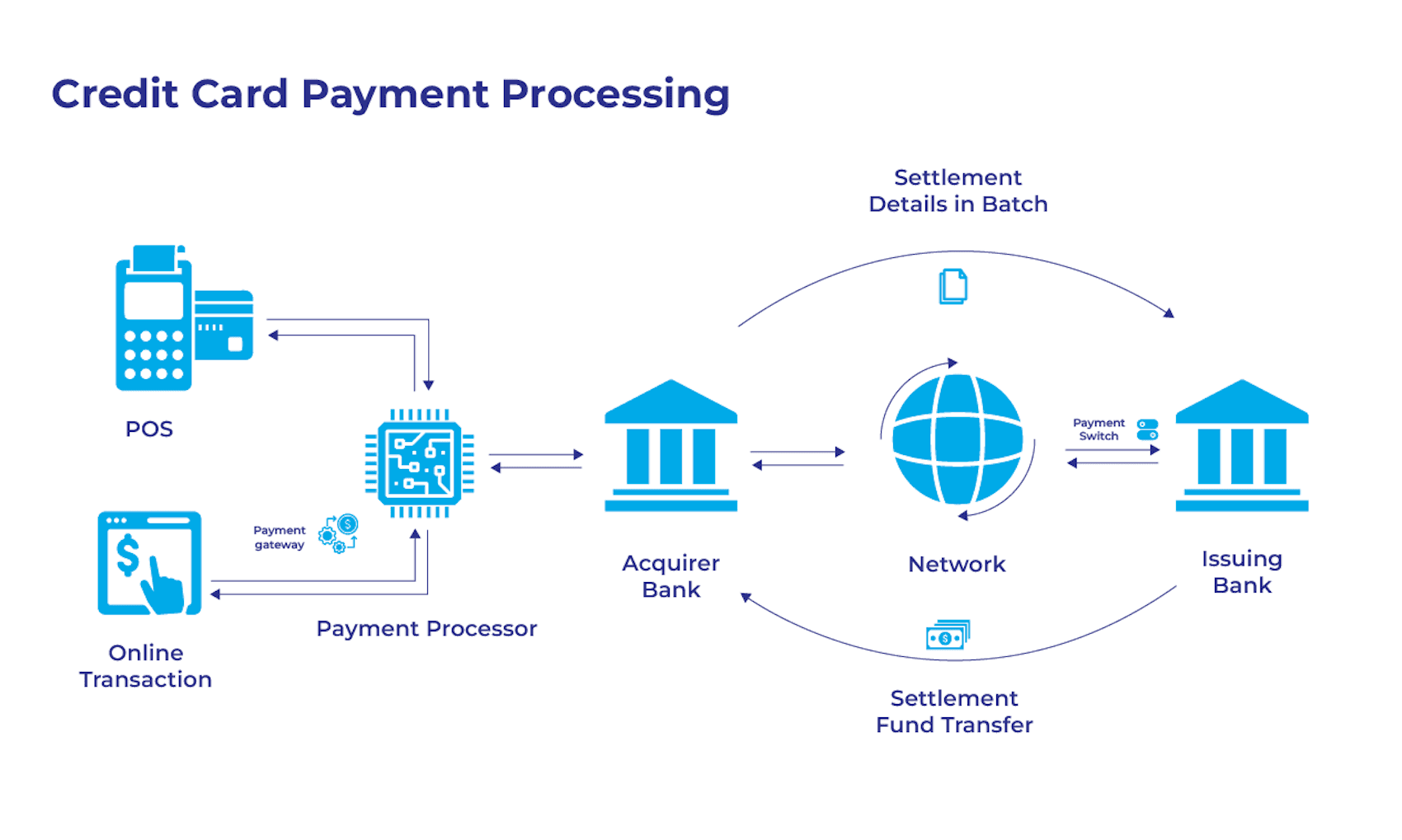

Credit Card Processing: A Simple Guide for Businesses

How to Secure Credit Card Transactions with Strong Passwords

Secure Online Payments: Your Guide to Using SSL

Phishing Scam Prevention Best Practices for Retailers

Secure Credit Card Transactions: A Guide to Using VPNs

How to Choose the Right Credit Card Terminal for Your Business

Secure Wire Transfers: A Guide to Two-Factor Authentication

Preventing Return Fraud in Banking: Best Practices

Prevent Credit Card Fraud in Retail: Best Practices

Secure E-commerce with Multi-Signature Wallets: A How-To Guide

Secure E-commerce Purchases: Your Guide to Tokenization

QuickBooks Online for Small Businesses: A Simple Guide

Lightspeed POS: A Practical Guide for Businesses

Turning High-Risk into High Growth: There’s a new path forward in payment processing

Merchants are tired of accidentally becoming payments specialists

Preventing Return Fraud in Transportation: Best Practices

Exploring the Future Trends and Technologies Shaping the Subscription Payment Landscape

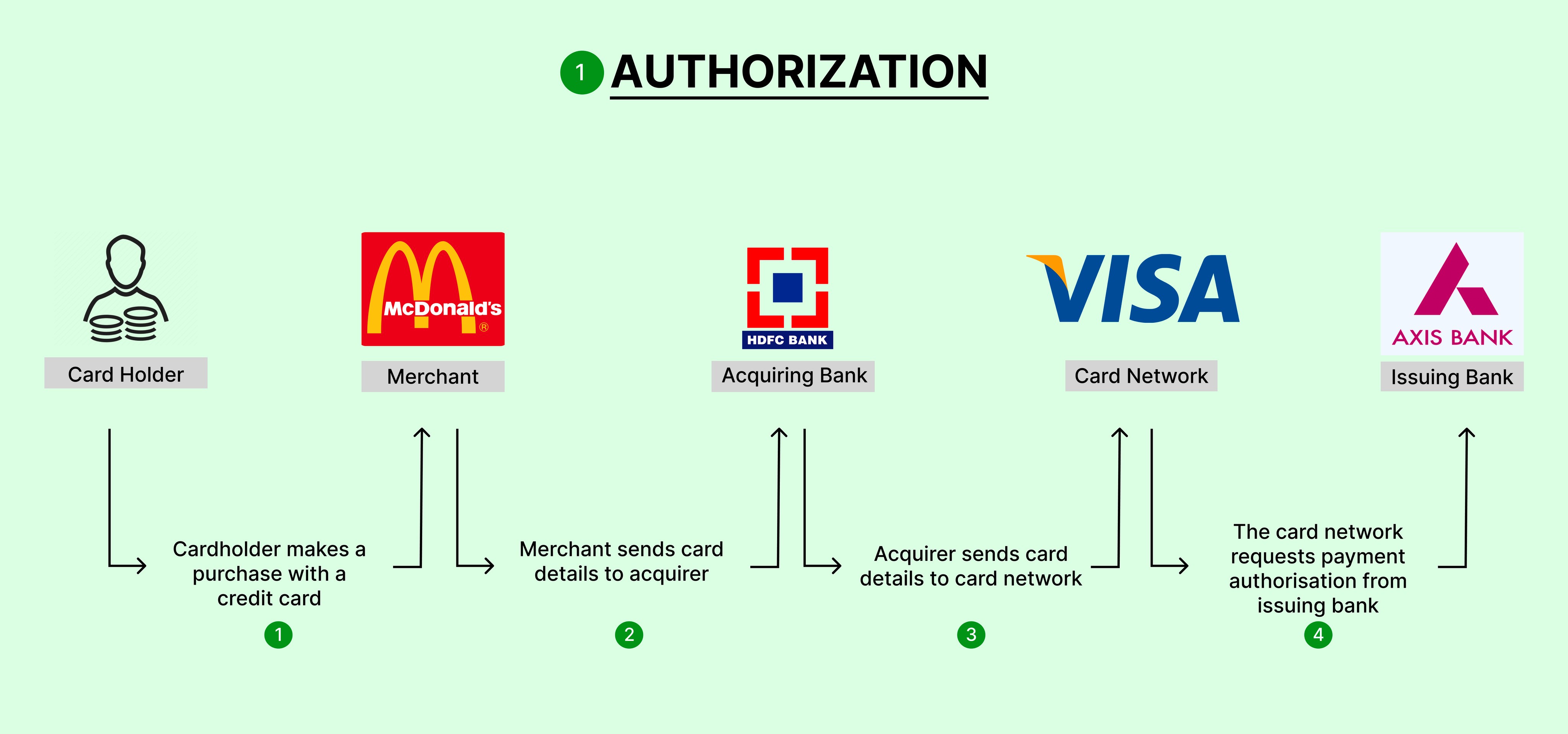

Authorization Rates: A Complete Guide for Businesses

Handling Failed Payments and Retries in the Subscription Economy

Mastering CBD Payment Processors: Navigating High-Risk Challenges for Seamless Transactions

Understanding 3-D Secure: The Ultimate 2024 Guide to Payment Security

How to Reduce Cart Abandonment with Better Payment Flow

Overcoming Subscription Payment Hurdles: Expert Solutions for Seamless Transactions

Mastering Payment Metrics: Unlocking Insights to Drive Business Success

High Ticket Sales: A Complete Guide

Understanding Payment Gateways vs. Processors: A Simple Guide

How to Reduce Chargebacks: A Practical Guide

Understanding High-Risk Payment Processing: The Ultimate Guide for 2024

Overcoming Real-Time Payment System Challenges: Essential Considerations for 2024

Future of Contactless Payments: Unlocking the Cutting-Edge Technologies and Innovations Transforming Transactions

Unlocking Success: Proven Payment Solutions for the Gig Economy

Mastering CBD Payment Processing: Proven Strategies for Success

Unlocking the Future of Real-Time Payments: Innovations and Technologies You Need to Know

CBD Payment Processing: Navigating the Complex Landscape

Future of AI in Payment Processing: Emerging Technologies and Predictions for Adoption

Successful Subscription Models: Case Studies and Best Practices

How to Find a High-Risk Merchant Services Provider

Understanding Authorized Push Payment Fraud: A Guide

Understanding Transaction Fees in Online Marketplaces

Harnessing the Power of AI: Revolutionizing Payment Processing for Business Success

Effective Billing Strategies for Adult Entertainment Businesses

PSD2 and SCA: What E-Commerce Businesses Need to Know

Smart Cannabis Billing Strategies for Dispensaries

Examples of Businesses with Effective Loyalty Programs

Navigating Regulatory Challenges in Payment Processing for Telehealth

Why Are Chargebacks Bad for Business?

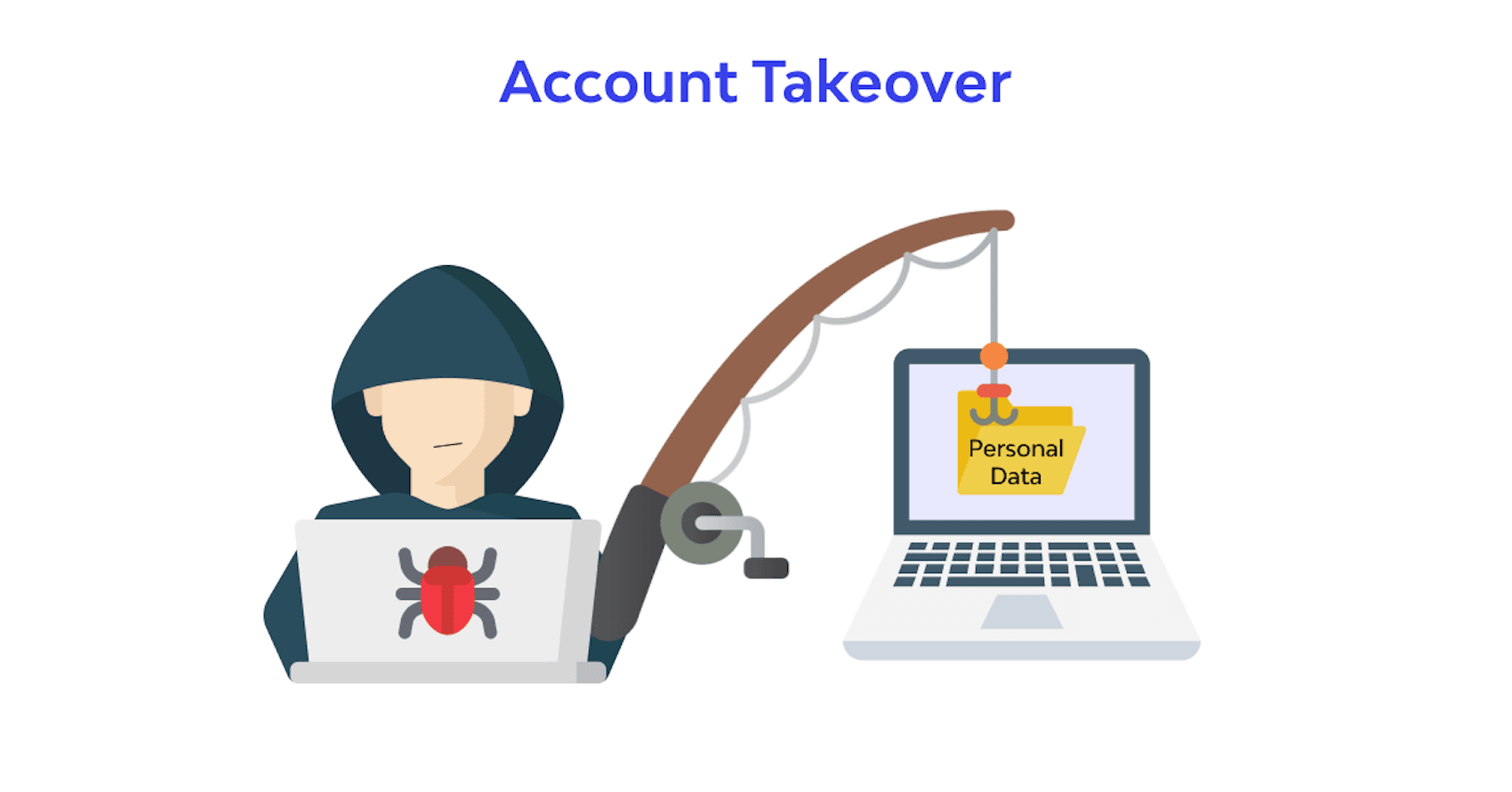

Account Takeover Fraud: What It Is and How to Stop It

How to Detect Bill of Lading Fraud: Key Signs and Tips

Steps to Integrate Cryptocurrency Payments: Choosing the Right Payment Processor and Ensuring Security and Compliance

Integrating Voice-Activated Payments: A Step-by-Step Guide

Blockchain in Payment Processing: Overcoming Technical, Regulatory, and Adoption Challenges

Improve Payment Authorization Without Losing Security

Understanding CBD Payment Processing: Challenges, Solutions, and Best Practices

The Ultimate Guide to Online Payment Fraud Detection

Edge vs Square: Which Payment Platform Is Right for You?

What Every E-Commerce Business Needs to Know About Payment Fraud

Ensuring Timely and Accurate Payments in the Gig Economy

Overview of Payment Processors for Subscriptions

How to Improve Your Checkout Page for More Sales

What Factors Determine a High-Risk Merchant?

Steps to Integrate Real-Time Payments: Choosing the Right Technology and Provider

What SMBs Need to Know About Handling Payment Disputes

How to Accept Credit Card Payments for Tobacco

Authorization Rates in Gaming: A Complete Guide

Accepting Credit Card Payments for Cannabis: What You Need to Know

What Businesses Should Know About 3D Secure Payments

What Is Credit Card Account Updater (CAU) and Why It Matters

Payment Processing for Wine Clubs: Simplify Your System

Subscription Payment Processing: Benefits and Best Practices

What Are High-Risk Payments on Stripe?

Steps to Integrate Contactless Payments: Choosing the Right Technology and Provider

Key Features to Consider in Cross-Border Payment Solutions

Why 3D Secure 2.0 Matters for E-Commerce Fraud Prevention

Future Trends in High-Risk Payment Processing You Should Know

Interchange Fees: A Complete Guide for Merchants

High-Risk Payment Processing: A Step-by-Step Implementation Guide

Boosting Customer Retention, Sales, and Experience with Loyalty Programs and Payment Processing

Cost Management Strategies for Startups: Reduce Payment Processing Fees

Benefits of Contactless Payment Solutions: Convenience, Safety, and Customer Satisfaction

Top Gun Store Software Solutions for Compliance

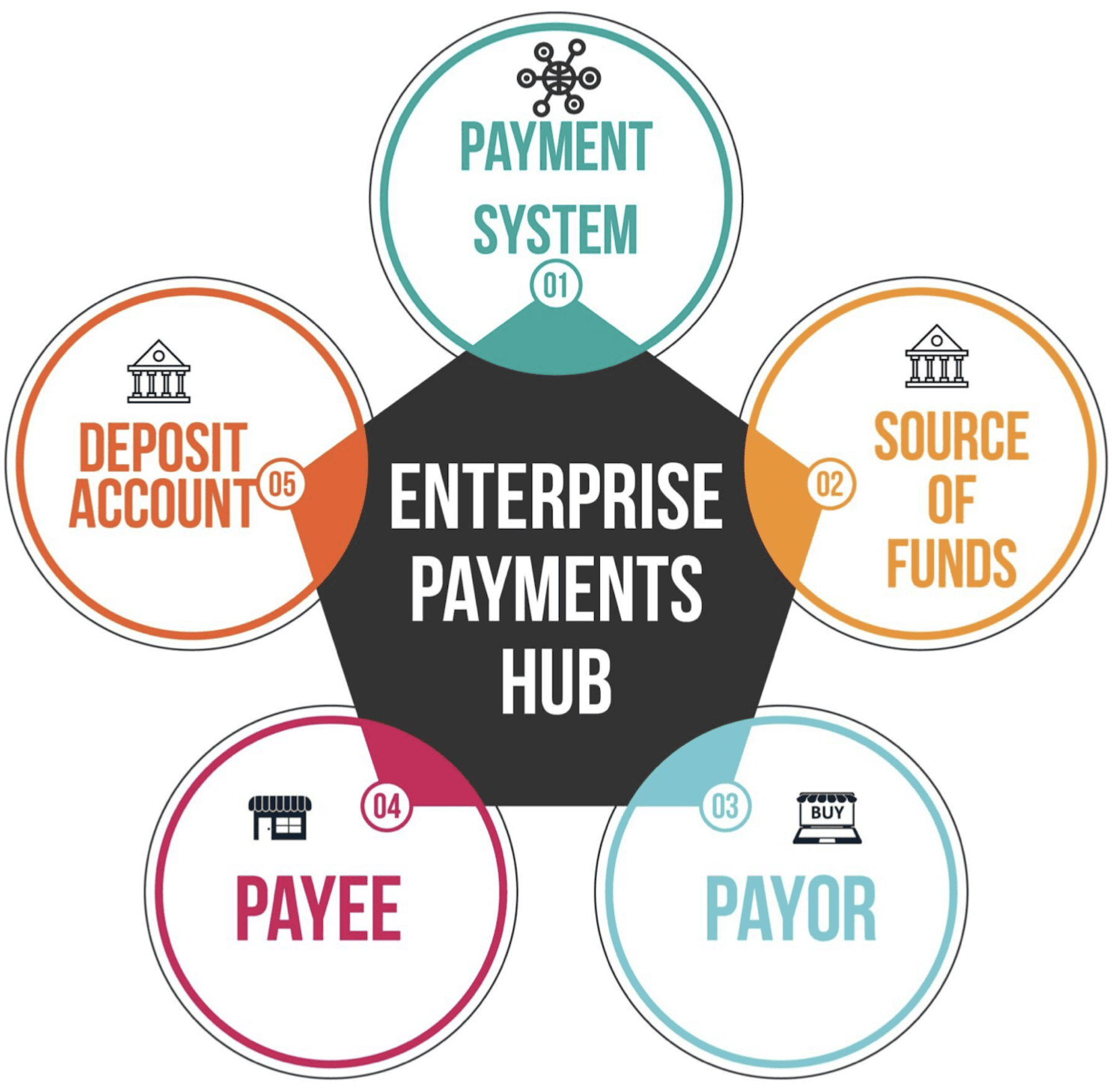

Top Payment Hub Solutions for Streamlined Transactions

Key Steps to Launching a Successful High-Risk Business

Return Policies: A Complete Guide

What Factors Make a Merchant Account High-Risk?

Best Practices for Paying Gig Workers: Choosing the Right Payment Platform

Challenges in Cannabis Payment Processing: Navigating the Complex Landscape

Telehealth Billing Made Simple: Key Strategies

Cryptocurrency Payment Solutions: Navigating Volatility, Regulatory Concerns, and Technical Integration

Exploring Leading Payment Processing Software for Business Efficiency in 2024

Personalized Payment Experiences: AI-Driven Customer Support in Payment Processing

Mastering Payment Solutions for Subscription Businesses: Unlocking Growth & Efficiency

Why Chargebacks Happen: Reasons & Prevention

Cannabis Return Policies: What You Need to Know

Edge vs. Helcim: Choosing the Right Payment Processor for Your Business

How Payment Processing Shapes Customer Satisfaction

What Are Chargebacks and How to Reduce Them

Basics of Real-Time Payment Systems

How to Choose the Best Payment Processing for Startups

When Do Subscriptions Take Their Payments Out? A Simple Guide

How Real-Time Payments Revolutionize Your Business: Faster Transactions & Enhanced Cash Flow

Overview of the Gig Economy: Growth and Impact on Traditional Employment within the Context of Payment Processing

Navigating the Complexities of Contactless Payment Solutions: Key Challenges and Strategies

Common Payment Frauds and How to Stay Safe

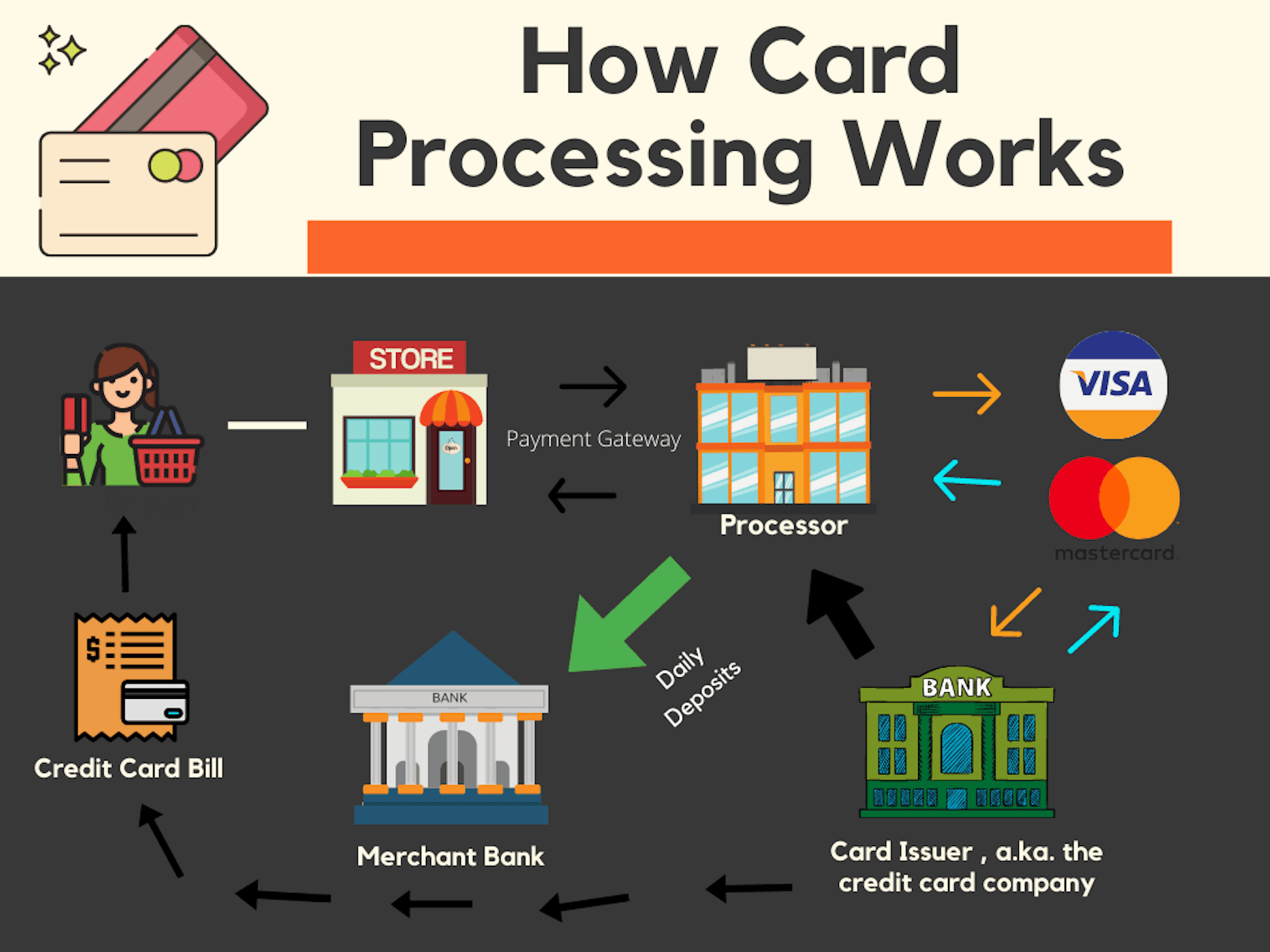

How Payment Processing Works: Unlocking the Secrets to Secure and Efficient Transactions

Cryptocurrency Payment Solutions: Lower Fees, Global Market Access, and Enhanced Security

Stripe: Features, Pricing, and Alternatives Compared

Understanding Transaction Risk Scoring: The Ultimate Guide to Safeguarding Online Payments

Navigating Compliance with International Regulations for Cross-Border Payment Solutions

Vape Billing Strategies: A Complete Guide

Unpacking the Timeline: How Long Does Payment Process Take for Medical Incidents?

Best Practices for Handling Recurring Billing: Ensuring Payment Continuity and Customer Retention

Unlocking the Future: Innovative Cannabis Payment Processors for a Thriving Industry

Top Vape Store POS Systems: What You Need to Know

Winning Billing Strategies for Travel and Tourism

Adult Entertainment: How to Accept Credit Card Payments

Real-Time Payment Systems: Faster Transaction Times, Improved Cash Flow Management, and Enhanced Customer Experience

Financial Technology Services: What You Need to Know

How Many Chargebacks Are Normal? A Guide for Businesses

Understanding High-Risk Payments: Navigating the Complexities for Your Business

Basics of Contactless Payment Technology

Increase Your Payment Acceptance Rates Using Data Analysis

What Are High-Risk Merchant Accounts?

The Ultimate Guide to Setting Up Online Payment Processing for Your Business

Basics of Loyalty Programs: Types and Integration with Payment Processing

Understanding ACH Payment Processing: The Ultimate Guide for Businesses

Basics of Cross-Border Transactions: Challenges and Opportunities

Turn Relationships into Revenue: A Practical Guide

Emerging Technologies and Innovations in Real-Time Payment Systems: Predictions for Adoption

Growth of Subscription-Based Businesses: Benefits of the Subscription Model

Online Payment Solutions: A Business Owner's Guide

The Ultimate Guide to Mastering API Payment Processing: Boost Security and Efficiency

Payment Processing for Gun Stores: What You Need to Know

Building Customer Loyalty: A Guide for CBD Businesses

Basics of AI and Machine Learning: Applications in Payment Processing

Basics of Voice-Activated Payment Technology

Guide to Restaurant Payment Processing: Everything You Need to Know

Basics of Blockchain Technology and Its Application in Payment Processing

Payment Management: Key Facts and Benefits

How to Reduce Risk in Payments: Implement Real-Time Transaction Monitoring and Set Up Alerts for Suspicious Activities

How to Maintain Healthy Cash Levels for Your Business

How Tech Industry Can Help Cannabis Companies: Leveraging Data Analytics to Drive Business Decisions

Market Guide for Online Fraud Detection: Key Insights

How Tech Industry Can Help Cannabis Companies: Digital Marketing Strategies and E-commerce Platforms

What Businesses Need to Know About ISO 8583 in Payments

Steps to Take If Your Business Is Categorized High-Risk

How to Reduce Risk in Payments: Leveraging Machine Learning and AI

Edge vs. National Processing: A 2023 Comparison

Top Payment Processors for Franchise Restaurants

5 Top High-Risk Payment Processors You Should Know

Mastering High-Risk Payments: The Essential 2024 Guide for Secure Transactions

How to Accept Credit Card Payments: A Complete Guide

How to Reduce Risk in Payments: Perform Regular Security Audits and Address Security Gaps Promptly

How to Reduce Risk in Payments: Implement Multi-Factor Authentication (MFA) for All Payment Transactions

Which Payment Option Offers the Best Fraud Protection?

Integrate Loyalty Programs: Choosing the Right Technology and Provider

How to Best Serve Customer Needs to Improve Satisfaction and Loyalty

Unlock the Best Payment Processing Solutions for Startups: A 2024 Guide

Strategies to Make Your Online Business Stand Out in a Crowded Market

Future Trends in Cannabis Payment Processing Companies: Innovative Solutions and Industry Growth

Ensuring Security and Accuracy in Voice-Activated Payment Solutions: Technical and Operational Challenges

Real-World Examples of Blockchain Implementation in Payment Processing

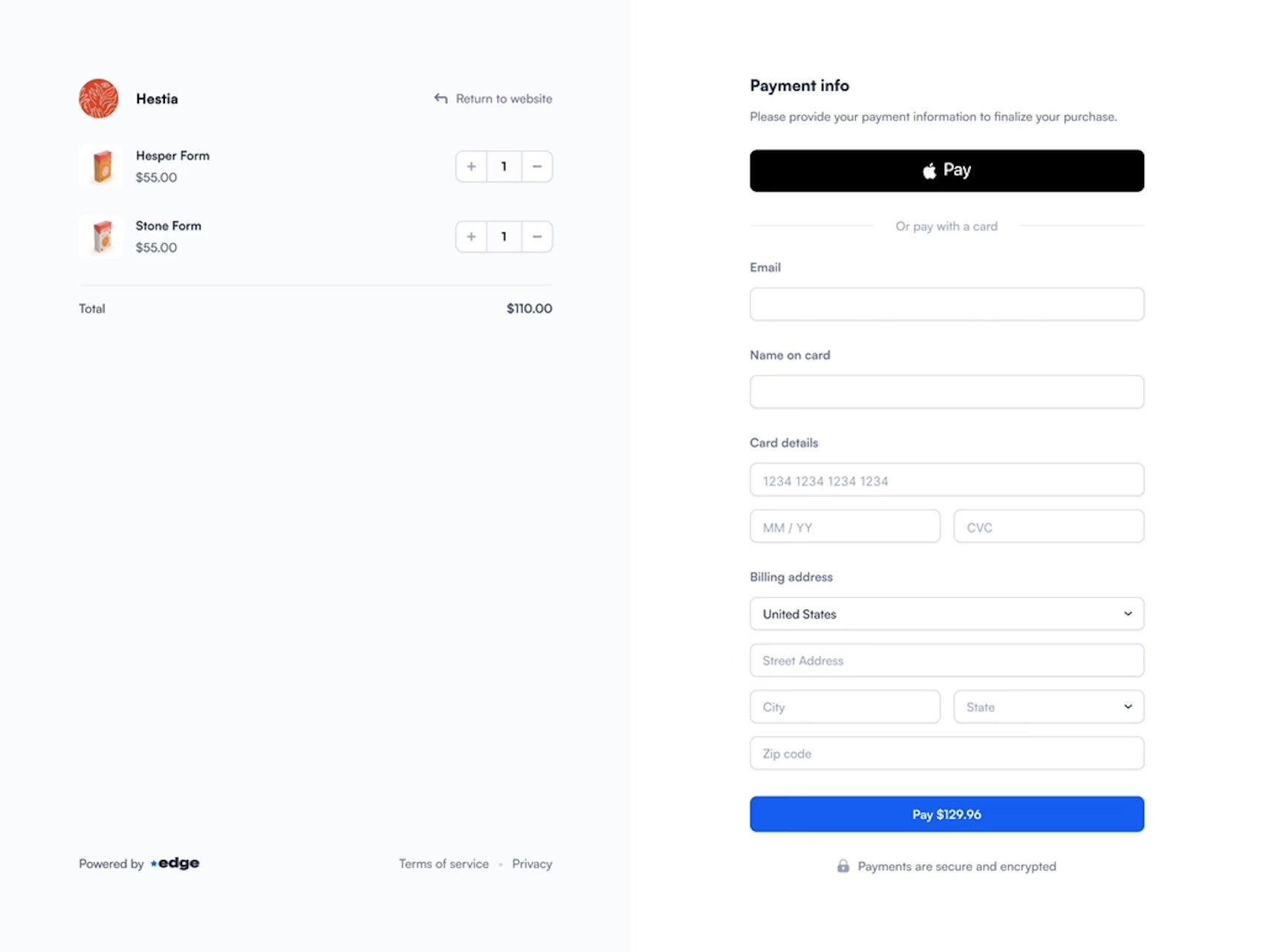

Hosted Checkout Solutions and How They Can Expedite the Setup Process for New Businesses

How Payment Processing Works 101: The Ultimate Guide for 2024

High-Risk Business? What You Need to Know About Payment Processing

Vape Return Policies: Your Complete Guide

What Does a Global Payments Fraud Specialist Do?

Best Practices to Increase Conversion Rates During the Checkout Process

Ensuring Data Security and Compliance in Loyalty Programs and Payment Processing

How Payment Links Make Invoicing Simple

Your Guide to Credit Card Processing Fees: Understanding the Costs

Best Subscription Payment Services for Your Business

Mastering Address Verification Service (AVS): Essential Tools for Secure Transactions

Which Industries Are Considered High-Risk for Payment Processors?

Payment Gateway for High-Risk Merchants

Unlocking the Power of Hosted Checkout: A Comprehensive Guide for 2024

How to Manage Google Payments and Subscriptions

The Advantages of Recurring Billing for High-Risk Businesses and Customers

Exploring Various Payment Solutions for High-Risk Businesses

Mitigate Chargebacks: A Practical Guide for Businesses

How to Use Analytics and Reporting Tools to Track the Performance of Your Subscription Billing

High-Risk Merchant Accounts in Payment Processing for High-Risk Industries

How to Monitor Transactions: A Practical Guide

The Importance and Functionality of Merchant Accounts for Nutraceutical Companies

Reviewing the Available Payment Gateway Options for Cannabis Businesses

Choosing the Right Cross-Border Payment Provider: Essential Features and Expert Comparisons for 2024

The Importance and Functionality of Merchant Accounts for Alcohol Beverage Companies

Steps to Begin a Business: Mastering Your Entrepreneurial Journey in 2024

Maximize Your Tax Savings: Are Payment Processing Fees Tax Deductible for Your Business?

Exploring the Complexities and Challenges of Processing Payments in the Cannabis Industry

Member Solutions Payment: A Complete Guide for Fitness Businesses

Unlocking the Benefits of Card-on-File

Understanding Online Payment Processing: The Ultimate 2024 Guide for Businesses

Emerging Technologies and Innovations: Predictions for Voice-Activated Payment Adoption

Mastering the Art of How to Start an Online Business: Essential Steps and Strategies

Navigating the Regulatory Challenges in Payment Processing for Alcohol Beverages

How to Set Up the Best Payment Processing for Startups

Exploring Effective Payment Solutions and Strategies for the Cannabis Industry

Benefits of High-Risk Payment Processing for Your Business

Identifying Effective Payment Solutions for Nutraceutical Companies

Which Payment Method Poses the Least Risk for Sellers?

Exploring the Complexities of Payment Processing in the Alcohol Beverage Industry

Payment Fraud Management: Best Practices for Businesses

Understanding the Role and Benefits of ACH Payments in the Cannabis Industry

Top SaaS Payment Solutions for Your Business

How to Qualify for High-Risk Merchant Services

Exploring the Complexities Involved in Payment Processing for Nutraceutical Companies

How Tokenization Enhances Payment Security and Efficiency

The Future of Technology Payments: Trends and Insights

Understanding the Complexities of Payment Processing in the Telehealth and Telemedicine Industry

Understanding Fintech Fraud: Types and Solutions

Predictions for Blockchain Adoption in Payment Processing

Payments Startups: Key Players and Trends to Watch

Navigating the Regulatory Challenges Associated with Cannabis Payment Processing

High-Risk Payment Gateway USA: What You Need to Know

Identifying Effective Payment Solutions for Alcohol Beverage Companies

Reduce Failed Transactions: Proven Strategies

Emerging Technologies and Their Potential Impact on Payments for Marijuana

Why Your Online Store Needs Multiple Payment Options

Reviewing the Best High-Risk Payment Processors for the Nutraceutical Industry

The Importance and Functionality of Merchant Accounts for Telehealth Companies

Exploring the Complexities of Regulatory Compliance in Cannabis Payment Processing

Gaming Billing Strategies: What You Need to Know

5 Best Payment Processing Solutions for Startups in 2024

Strategies for Minimizing Fees Associated with Cross-Border Payments

Mastering Hosted Checkout: Essential Customization Tips and Tricks for a Seamless Brand Experience

Understanding the Unique Challenges Faced by High-Risk Businesses in Securing Payment Processing Solutions

Avoid These 5 Common Payment Processing Mistakes

Mastering How to Start an Online Business: Essential Steps and Strategies for 2024

Identifying Effective Payment Solutions for Telehealth Companies

Unlock the Power of ACH Payment Processing: What Every Business Needs to Know

Regulatory Challenges in Payment Processing for the Alcohol Beverages Industry

Mastering Payment Processing Software: The Ultimate 2024 Guide to Streamline Your Business Transactions

What is a High-Risk Form of Payment?

A Comprehensive Guide to Payment Processing in the Cannabis Sector

Essential Strategies for Payment Processing for Small Businesses: The Ultimate 2024 Guide

Every Business Should Have Access to Fair Payment Processing Solutions

Understanding What is ACH Payment Processing? The Ultimate Guide for Businesses

Exploring Payment Processing Solutions for the Skilled Gaming Industry: High-Risk Payment Processing Solutions

Payment Processing for Travel Industry

Top 5 Payment Optimization Strategies for Startups

Ultimate Guide to Payment Processing for Small Businesses: Enhance Efficiency and Security in 2024

How Technology is Streamlining Cross-Border Payment Processes

How AI-Based Fraud Detection is Changing Banking

Understanding Online Payment Fraud: Risks and Solutions

Navigating Cannabis Payment Processing: Overcoming Banking Hurdles and Compliance Challenges

Why Payment Processor Uptime Matters for Business

Exploring Innovative Solutions that Promote Equal Access to Payment Processing for All Businesses

Mastering Payment Gateway Integration: The Essential Guide for Secure Online Transactions

An Analysis of the Factors That Complicate Payment Processing for Marijuana Companies

Innovative Payment Solutions: Transform Your Business

Subscription Payments: Streamlining Recurring Billing

ACH Payment Processing vs. Wire Transfer: Understanding Your Best Option

Equal Access to Payment Solutions: Why High-Risk Businesses Deserve It

Mastering Payment Processing for the Travel Industry: The Ultimate 2024 Guide

What You Need to Know About Payments at Pawn Shops

Secure Online Payments: A Guide to Strong Passwords

Understanding the Complexities of Payment Processing for CBD Products: Regulatory Challenges

How to Choose the Best Low-Cost Payment Processing Option for Your Business

Understanding the Regulatory Landscape for International Payments in Cross-Border Payment Solutions

How Premier Payment Solutions Can Transform Your Business

Large Payment Processors: What You Need to Know

Payment Management Systems: A Complete Guide

How Payment Fraud Analytics Protects Your Business

How Long Does Payment Process Take for Medical Incident? Decoding Timelines and Factors

What You Need to Know About Tobacco Return Policies

Exploring the Use of ACH Payments in the Cannabis Industry

How to Achieve Low-Cost Payment Processing: Essential Strategies for 2024

Tailored Payment Solutions for Businesses Operating in High-Risk Sectors

Optimizing API Payment Processing: Essential Best Practices for Security, Performance, and Compliance

Payment Solutions for High-Risk Businesses

How Are High-Risk Merchant Accounts Different From Regular Ones?

How Data Visualization Tools Help Detect Fraud

Exploring the Best Cannabis Payment Processing Companies: Your 2024 Guide

Understanding the Specific Regulatory Challenges for Marijuana Payment Processing

Mastering Low-Cost Payment Processing: Strategies to Slash Transaction Fees and Boost Profits

Exploring the Regulatory and Compliance Hurdles in Payment Processing for the Travel Industry

Mastering API Payment Processing: The Ultimate Guide for Modern Businesses

High-Risk Businesses Deserve Equal Access to Payment Solutions: A Necessity for Economic Inclusivity

Strategies for Dealing with Failed Subscription Payments and Reducing Involuntary Churn

Exploring the Reasons Why Every Business, Regardless of Risk Level, Should Have Access to Payment Solutions

Mastering Low-Cost Payment Processing: Strategies for Maximum Profitability

Mastering the Steps to Begin a Business: Your Ultimate 2024 Guide

Advocating for Equal Access to Payment Solutions for All Types of Businesses

What is ACH Payment Processing?

7 Proven Strategies for Payment Fraud Prevention

Exploring the Unique Payment Processing Needs of Nutraceutical Companies

Exploring Future Trends in Healthcare Payments: Revolutionizing the Industry with Emerging Technologies

ACH Transfers: The Complete Guide to ACH Payment Processing

How Monitoring Transactions Prevents Fraud and Protects Revenue

Payments for High-Risk Businesses: What You Need to Know

The Ultimate Guide on How to Start a Business: Unlocking Financial Success and Customer Satisfaction

Future-Proof Your Freelance Payments: Embracing Emerging Technologies and Trends

Examining Regulatory and Compliance Issues Faced by Nutraceutical Companies in Payment Processing

Mastering Subscription Models: Examples, Insights, and Best Practices for 2024

Regulatory Hurdles in Payment Processing for the Marijuana Industry

Difficulty of Care Payments and Social Security

Exploring the Future of Education Payments: Cutting-Edge Technologies and Strategic Predictions

Understanding Merchant Services: Enhance Business Operations, Improve Customer Satisfaction, and Boost Sales

Exploring Future Trends in Digital Goods Payments: Embrace Emerging Technologies and Stay Ahead

Strategies for Using Mobile Payment Solutions to Enhance Customer Experience and Drive Loyalty

Secure E-commerce Purchases with Two-Factor Authentication

Exploring the Best Cannabis Payment Processing Companies: A Comprehensive Guide

Preventing Return Fraud in Hospitality: Best Practices

Factors Influencing Consumer Adoption of Mobile Payment Solutions and How Businesses Can Encourage More Customers to Use Them

Future Trends in Travel Payments: What Emerging Technologies Mean for Your Business

PCI Compliance 4.0: Ensuring Secure Payments and Adapting to New Requirements

How to Improve Cannabis Authorization Rates: Strategies for Success

Understanding Global Payments Fraud: What You Need to Know

Expert Strategies for Preventing Fraud in Healthcare Payments

ACH Transfers: The Complete Guide to Trends and Innovations Shaping the Future of Payment Processing

Mastering Non-Profit Payment Security: Essential Compliance Strategies for Secure Donations

Identifying and Overcoming Common Challenges in Cross-Border Transactions

Future Trends in Retail Payments: Unlocking Cutting-Edge Technologies & Predictions

A Guide to Resolving Common Problems with Hosted Checkout Solutions

Unlocking Business Potential: Integrate Payment Analytics with BI Tools for Strategic Insights

Best Practices for Securing Online Payments: How to Accept Credit Card Payments Online

Mastering Mobile Payment Integrations: Boosting Your E-commerce Success

A Comprehensive Comparison Between Hosted and Self-Hosted Checkout Solutions

Mobile Payment Solutions for Digital Goods: Elevate Your Business with Seamless Integration

Top Gun Store POS Systems: What You Need to Know

Understanding Payment Gateways: How to Accept Credit Card Payments Online

Payment Processing for High-Risk Businesses: What You Need to Know

Mastering Freelance Taxes: Essential Strategies for Managing Payments and Compliance

PCI Compliance: Analyzing Costs and Determining Value for Your Business

Understanding Payment Risk: Key Strategies for Businesses

Mastering Subscription Analytics: Unlocking Key Metrics for Business Growth in 2024

Exploring Payment Solutions for the Skilled Gaming Industry in Emerging Markets

How to Safeguard Educational Payments: Effective Strategies Against Fraud

Hosted Checkout Solutions: An Overview of What Hosted Checkout Is and How It Works

Ultimate Guide to Mobile Payment Solutions for Travel Businesses in 2024

An Overview of the Latest Trends and Technological Advancements in Online Payment Processing: How to Accept Credit Card Payments Online

How to Identify Safe Online Transactions

How High-Risk Accounts Differ From Regular Accounts

Protect Your Business: Stop BIN Attacks in Their Tracks

Best Practices for Managing Recurring Payments to Minimize Churn and Maximize Customer Retention

Tools and Services for Efficient Currency Conversion in Cross-Border Payments

Harnessing Payment Data: Transform Customer Insights, Personalization, and Retention

Examining the Payment Processing Solutions Available for the Cannabis Industry

The Ultimate Guide to Mobile Payment Solutions in Education: Enhancing Efficiency and Convenience

How Your Merchant Account Can Unlock Rewards

Enhance Customer Loyalty with Smart Payment Solutions

Exploring the Payment Processing Options for the CBD Industry: A Guide for Emerging Markets

Subscription Billing for E-commerce: Mastering Recurring Payments and Subscription Management

Discussing the Difficulties and Regulatory Challenges in Cannabis Payment Processing: Industry-Specific Payment Solutions

Optimized Payment Solutions for Fundraising Events: Enhancing Experiences and Managing Transactions Efficiently

Effective Payment Solutions Tailored for High-Risk Businesses

Mastering Mobile Payment Solutions in Healthcare: Importance, Best Practices, and Future Trends

Exploring the Reasons Behind the Complications in Payment Processing for Marijuana Companies

Card Testing Fraud: How to Protect Your Business

Understanding the Regulatory Challenges in Payment Processing for Nutraceuticals

Examining the Unique Challenges Faced by the Travel Industry in Payment Processing: Regulatory Hurdles in Payment Processing

Vape Payment Processing: Solutions for High-Risk Merchants

Navigating the Best CBD Payment Processors: Your Ultimate 2024 Guide

Understanding the Complexities and Regulatory Issues Surrounding Cannabis Payments

Navigating Gig Economy Payments: Overcoming Common Challenges with Modern Solutions

Understanding Merchant Services: Breaking Down Payment Processing Fees and Their Impact on Businesses

Top Healthcare Payment Technologies You Should Know

Practical Guide to Effective Team Leadership

Mastering CBD Payment Processors: Essential Integration Guide for Your Business

Regulatory and Operational Challenges in Payment Processing for Telehealth and Telemedicine

Navigating Regulatory Challenges in Cross-Border Payments: A Comprehensive Guide for 2024

Examining Payment Processing Solutions for the THC Industry within the Context of Payment Processing for Emerging Markets

Driving Subscription Success: Mastering Revenue Optimization, Churn Reduction, and Customer Experience

Understanding the Complexities and Challenges in Payment Processing for the CBD Industry

The Complete Guide to International High-Risk Payment Gateways

Mastering Invoicing and Payment Solutions for Freelancers: Essential Best Practices and Integration Tips

Understanding the Complexities in Payment Processing for Nutraceutical Companies

Merchant Accounts for Pawn Shops: What You Need to Know

Top Subscription Payment Gateways for Your Business

Mastering Fraud Prevention in Digital Goods Payments: Essential Strategies and Solutions

PCI Compliance: Ensuring Secure Payments – Detailed Insights into the Comprehensive PCI Data Security Standard (DSS) Checklist

Transforming Travel Payments: Enhancing Customer Experience and Streamlining Cancellations

Understanding the Payment Processing Needs of Skilled Gaming Companies in Emerging Markets

Understanding Address Verification Service (AVS): A Comprehensive Guide for Fraud Prevention in 2024

Understanding What a High-Risk Merchant Account Is and How to Obtain One

Mastering Omni-Channel Payment Solutions: Creating a Seamless Customer Experience Across All Channels

Comprehensive Payment Solutions for High-Risk Businesses

Unlocking the Power of Mobile Donations: A Comprehensive Guide for Non-Profits

Preventing Loan Fraud in Insurance: Best Practices

Innovations in Mobile Payment Solutions

Secure Bill Payment: Protecting Your Transactions

Unlock Global Sales Potential: The Essential Guide to Multi-Currency Payment Solutions

Top Insurance Fraud Detection Tools You Need to Know

Compare EFT and ACH Transfers: Determine Which is Best for Your Business Needs

Harnessing Data to Slash Payment Failures: Strategies for Optimized Transactions

Understanding Merchant Services: A Look at Upcoming Trends and Technological Advancements in Payment Processing

The Ultimate Guide to Online Payment Solutions for Healthcare in 2024

Mastering Payment Gateway Integration: The Ultimate Guide for Seamless Online Transactions

Understanding Merchant Services: An Overview of Payment Processing and Its Crucial Role

Fraud Detection Using Big Data Analytics

Exploring the Best Subscription Payment Gateways: Features and Integration Strategies for Seamless Transactions

How to Get an SBA Startup Loan: A Step-by-Step Guide

PCI Compliance: Ensuring Secure Payments

Mastering International Payments for Freelancers: Expert Tips for Efficient Cross-Border Transactions

Best Practices and Solutions for Securing Payment Information and Preventing Fraud in Merchant Services

What is Address Verification Service (AVS)? Understanding Its Role in Secure Payment Processing

ACH Transfers: The Complete Guide to Simplifying Payroll Processing and Enhancing Financial Management

Exploring What are Payment Methods: The Ultimate Guide for Modern Businesses

Revolutionizing Transactions with Mobile Payment: Innovations in Mobile Payment Solutions

Payment Fraud Trends: What Businesses Need to Prepare For

Mastering Subscription Models for Digital Goods: Your Ultimate 2024 Guide

Steps and Tips for Seamlessly Integrating Merchant Services and Payment Processing into Your Existing Systems

Mastering B2B Payment Processing for Maximum Efficiency and Cost Savings

ACH Transfers: The Complete Guide to Fundamental Principles, Functionality, and Importance

Mastering Online Payment Solutions for Educational Institutions: Essential Features & Integration Strategies

Strategies to Manage and Reduce Costs Associated with Online Payment Processing

Unlocking Retail Success: Benefits and Integration Strategies for In-Store Mobile Payments

An Introduction to Virtual Terminal Credit Card Processing: How to Accept Credit Card Payments Online

Secure Your Travel Business: Top Strategies to Prevent Payment Fraud

Disadvantages of High-Risk Accounts: A Complete Guide

Understanding Payment Fraud: Types and Prevention Tips

Key Factors to Consider When Selecting a Merchant Service Provider: Understanding Merchant Services

Unveiling AI: The Future of Fraud Detection in Payment Processing

Secure Your Crypto Exchange: How Tokenization Works

PCI Compliance: Ensuring Secure Payments - Exploring Different PCI Compliance Levels

Navigating Cryptocurrency Payment Challenges: Overcoming Volatility, Regulation, and Integration Barriers

Exploring the Benefits of High-Risk Merchant Services for Businesses

How to Select the Best CBD Payment Processors: Expert Tips and Insights

ACH Transfers: The Complete Guide - Exploring ACH Credit and ACH Debit Transactions

Secure Mobile Payments: Your Guide to Two-Factor Authentication

Emerging Technologies and Innovations: Predictions for Contactless Payment Adoption

One-Click Checkouts: Reduce Cart Abandonment Now

Important Factors to Consider When Selecting a Merchant Services Provider for Online Credit Card Transactions

Mastering Real-Time Payments: A Step-by-Step Guide to Integration and Technology Selection

The Impact of Mobile Payment Solutions in Emerging Markets and How They Are Driving Financial Inclusion

Master the Future of Transactions: Implementing Contactless Payment Solutions

An In-Depth Look at the Growing Popularity of Mobile Wallets like Google Wallet and Apple Pay

How to Use Firewalls to Secure International Remittance

Unlocking Cost Savings with Optimized Payments

Understanding Authorization Rates in Medicine

Pharmaceutical Billing Strategies: A Complete Guide

How Much Are High-Risk Merchant Account Fees in 2024?

Top Strategies for Finding Credit Card Processing Leads

Mastering Patient Payments: Strategies for Seamless Transactions and Enhanced Experience

Explaining Recurring Payments and Common Use Cases in Various Industries

Mastering Seamless Checkout: Techniques for a Frictionless Payment Process

Secure Bank Transfers: How Biometric Verification Works

Seamlessly Integrate Online Payments: Tips for Accepting Credit Card Payments Online

Preventing Identity Theft in Manufacturing: Best Practices

Mastering Tuition Payments: Best Practices for Streamlined Processing and Enhanced Student Experience

How to Prevent Payment Fraud: Essential Tips for Businesses

PCI Compliance: Ensuring Secure Payments - How to Prepare for a PCI Compliance Audit

Choosing the Best Payment Platform for Freelancers: Essential Features and Comparisons

How to Secure Your E-commerce Purchases with Strong Passwords

Innovations in Mobile Payment Solutions: An Overview of Security Measures Protecting Mobile Payments

Top Hotel Payment Solutions to Enhance Guest Experience

SBA Loans for Startups: The Ultimate Guide

Secure Your P2P Payments with Two-Factor Authentication

Mastering Multi-Currency Payments: A Crucial Guide for Travel Businesses in 2024

PCI Compliance: Ensuring Secure Payments with Comprehensive Services

10 Effective Ways to Mitigate Online Security Incidents

Best Practices to Prevent Insurance Fraud in E-commerce

Top Tools to Master Transaction Risk Scoring for Optimal Payment Security

ACH Transfers: The Complete Guide to Understanding ACH Withdrawals and Streamlining Your Payment Processing

The Ultimate Guide to Mastering Transaction Risk Scoring for Fraud Prevention

ACH Transfers: The Complete Guide to Security Protocols and Protecting Your Business from Fraud

Unleashing the Power of Microtransactions: Best Practices and Customer Experience Enhancement

Exploring the Technology Behind 3D Secure Payments: Enhancing Fraud Protection in Payment Processing

The Ultimate Guide to Mobile Point-of-Sale (mPOS) Systems

Ultimate Guide to Managing Recurring Billing: Best Practices for Payment Continuity & Customer Retention

Best Practices for Integrating Mobile Payment Solutions with Existing Payment Processing Systems

Understanding Merchant Services: Definition, Types, and Roles in the Payment Ecosystem

Tools and Technologies for Robust Fraud Protection

Donation Processing Solutions 101: Best Practices and Top Platforms for Non-Profits in 2024

Best Practices to Prevent Phishing in Insurance

A Guide to Implementing Best Practices for Secure Payments and to Minimize Fraud Risks

Transforming Payment Processing with AI: Elevate Customer Experience and Security

Exploring the Latest Trends and Innovations in Secure Payment Technologies for Fraud Protection

Unlocking Growth: How Integrating Loyalty Programs with Payments Can Revolutionize Your Business

Payment Processing Technology: What Every Business Should Know

How to Secure Credit Card Transactions with Biometric Verification

Prevent Payroll Fraud in Insurance: Best Practices

Insight into How Machine Learning Algorithms Can Identify and Prevent Fraudulent Payment Activities

Mastering Gig Platform Payments: Strategies for Timely and Accurate Payouts

Understanding Why Businesses Need to Prioritize Fraud Protection in Payment Processing

Navigating Blockchain's Complex Landscape: Challenges and Limitations in Payment Processing

Predicting the Evolution of Fraud Protection Strategies and Technologies in Payment Processing

Top Payment Technology Companies You Should Know

Unlock the Power of Cryptocurrency: Why Your Business Should Adopt Digital Payments Now

Choosing the Right Payment Solution Provider for Your Online Casino

Advantages of High-Risk Accounts: A Complete Guide

Understanding How Chargebacks Impact High-Risk Merchant Accounts and How to Effectively Manage Them

How to Accept Credit Card Payments Online: A Comprehensive Guide for Businesses

Breaking Down the Fee Structure and Costs of High-Risk Merchant Accounts

Mastering Recurring Payments: Best Practices for Seamless Billing and Customer Retention

Key Factors to Consider When Selecting a Payment Processor for High-Risk Merchant Accounts

Harnessing the Future: Cutting-Edge Innovations in CBD Payment Processors for 2024

A Comprehensive Guide to High-Risk Merchant Accounts and Why Businesses Might Fall Into This Category

Mastering Payments for Gig Workers: Best Practices and Platform Selection Guide

Identifying Common Challenges Faced with Recurring Billing and Potential Solutions in Subscription Payments

Secure Crypto Trading: Your Guide to Using a VPN

How to Set Up and Use a Virtual Terminal for Processing Credit Card Payments

7 Best Practices for Preventing Real Estate Return Fraud

Understanding Merchant Services Commission Structures

Understanding Payments Fraud: Risks and Prevention Tips

Best Practices for Preventing Telecom Credit Card Fraud

Smart Billing Strategies for Tobacco Cessation Services

An Overview of Subscription Payments and How They Work

Understanding ACH Payment Fraud: What You Need to Know

Real-World Examples of Businesses Successfully Navigating High-Risk Merchant Accounts

Mobile Fraud Detection: Best Practices for 2024

Tips and Strategies to Enhance the Payment Experience on Your Site to Increase Customer Satisfaction and Reduce Cart Abandonment

How to Implement Low-Cost Payment Processing for Maximum Business Savings in 2024

A Must-Read Checklist for Setting Up Merchant Services for Your Online Store

Payment Processing Solutions for Pawn Shops

Unlock the Power of API Payment Processing: A Comprehensive Guide for 2024

Tips and Best Practices for Efficiently Managing and Processing Subscription Payments

Latest Trends and Innovations in the Online Payment Industry

Payment Processor Guidelines: A Business Owner's Guide

Trends and Future Developments in Recurring Payments for Subscription Services

Emerging AI Technologies: Predictions for AI Adoption in Payment Processing

Exploring the Impact of Online Payment Systems on Subscription-Based Business Models

Emerging Technologies and Innovations: Voice-Activated Payments

Payment Solutions for High-Risk Industries: An Overview of Various Sectors and Their Challenges

Preventing Insurance Fraud in Hospitality: Best Practices

Elevate Your Customer Strategy: Integrating Loyalty Programs with Payment Processing for Maximum Impact

Best Practices for Minimizing Fraud and Improving Transaction Security for High-Risk Merchants

Unlocking Customer Loyalty: Seamlessly Integrate Payment Processing for Business Growth

How to Accept Credit Card Payments Online: A Comprehensive Guide

Mastering the Basics: How to Start a Business and Thrive in 2024

Reviewing the Best Payment Processing Solutions for High-Risk Industries

Step-by-Step Guide to Implementing Recurring Billing for Your Business

Understanding the Subscription Economy: Key Growth Factors and Benefits for Businesses

Important Security Aspects to Consider When Dealing with Online Subscription Payments

Unlocking the Best Payment Gateways for E-commerce Success in 2024: A Comprehensive Guide

Selecting a Payment Processor Tailored to Recurring Billing Needs for Subscription Payments

How the Gig Economy is Revolutionizing Work and Payment Solutions

A Deep Dive into Recurring Billing and Its Benefits in Subscription Payments

What Is a High-Risk Business? Key Facts You Need to Know

Top Payment Fraud Detection Companies You Should Know

International High-Risk Payment Gateways: A Complete Guide

Texas Dealer Solutions Online Payment: A Simple Guide

Secure Payment Solutions: A Comprehensive Guide

Handling Objections in Merchant Services Sales

How to Maximize Savings: Are Payment Processing Fees Tax Deductible?

How to Secure Peer-to-Peer Payments with SSL

How to Secure Wire Transfers with a VPN

Credit Card Transactions: A Complete Guide

How Subscription Payments Can Transform Your Business

Boosting Security and Trust: The Power of Transaction Risk Scoring in Payment Processing

QuickBooks Credit Card Processing Fees: Detailed Insights and Cost-Reduction Strategies

Unveiling Loyalty Programs: A Comprehensive Guide to Types and Integration with Payment Processing

Comprehensive Guide on How to Integrate QuickBooks with Popular Payment Gateways for Streamlined Financial Management

How to Implement 3-D Secure: A Step-by-Step Guide for Businesses

How to Choose the Right High-Risk Account Provider

Best Payment Gateways Reviewed: Features, Pricing, and Benefits for Your Online Business

Digital Payments: Ensuring Security in Every Transaction

The Ultimate 2024 Guide to Cannabis Payment Processing Companies: Ensuring Compliance and Customer Satisfaction

The Ultimate Guide to Implementing Transaction Risk Scoring in Your Business

Advice to Manage and Mitigate Chargebacks and Disputes

Cannabis Payment Processing: Guide to Innovative Solutions in 2024

Unlocking the World of Cryptocurrencies: A Comprehensive Guide for Payment Processing in 2024

Exploring the Latest Trends and Technological Advancements in Contactless Payment Solutions

AI in Payment Processing 101: The Ultimate 2024 Guide

Fraud Detection Rules: Essential Guide for Businesses

Comprehensive Guide to Enhancing Payment Security for Businesses

Unveiling the Future of API Payment Processing: Leading Providers and Key Benefits

You'll never need another payment processor again.

All businesses deserve a dependable

and transparent payments partner.

Eliminate the stress of payment processing issues with Edge. Empower your engineers with a well-documented & dependable payments API that enables them to focus on other critical tasks.

© 2025 Edge Payment Technologies, Inc.