Top Payment Hub Solutions for Streamlined Transactions

Centralize your transactions with top payment hub solutions. Learn how these platforms can streamline operations, improve compliance, and reduce costs.

Struggling with fragmented payment systems that eat up time and resources? Payment hubs could be your answer, centralizing all your transactions into one efficient platform. Discover how these powerful tools can transform your business operations, improve compliance, and reduce costs—all while offering advanced features like automation and analytics.

Key Takeaways

Centralization Enhances Efficiency: Payment hubs consolidate various payment methods into a single platform, streamlining transactions and reducing operational complexities.

Automation and Advanced Analytics: These solutions offer automation capabilities that minimize manual tasks and errors, along with analytics tools for better decision-making.

Comprehensive Solutions Available: Leading payment hub providers like Edge, Finastra, Nomentia, and others offer diverse features tailored to different business needs, including subscription management, risk scoring, and seamless bank integration.

What is a Payment Hub?

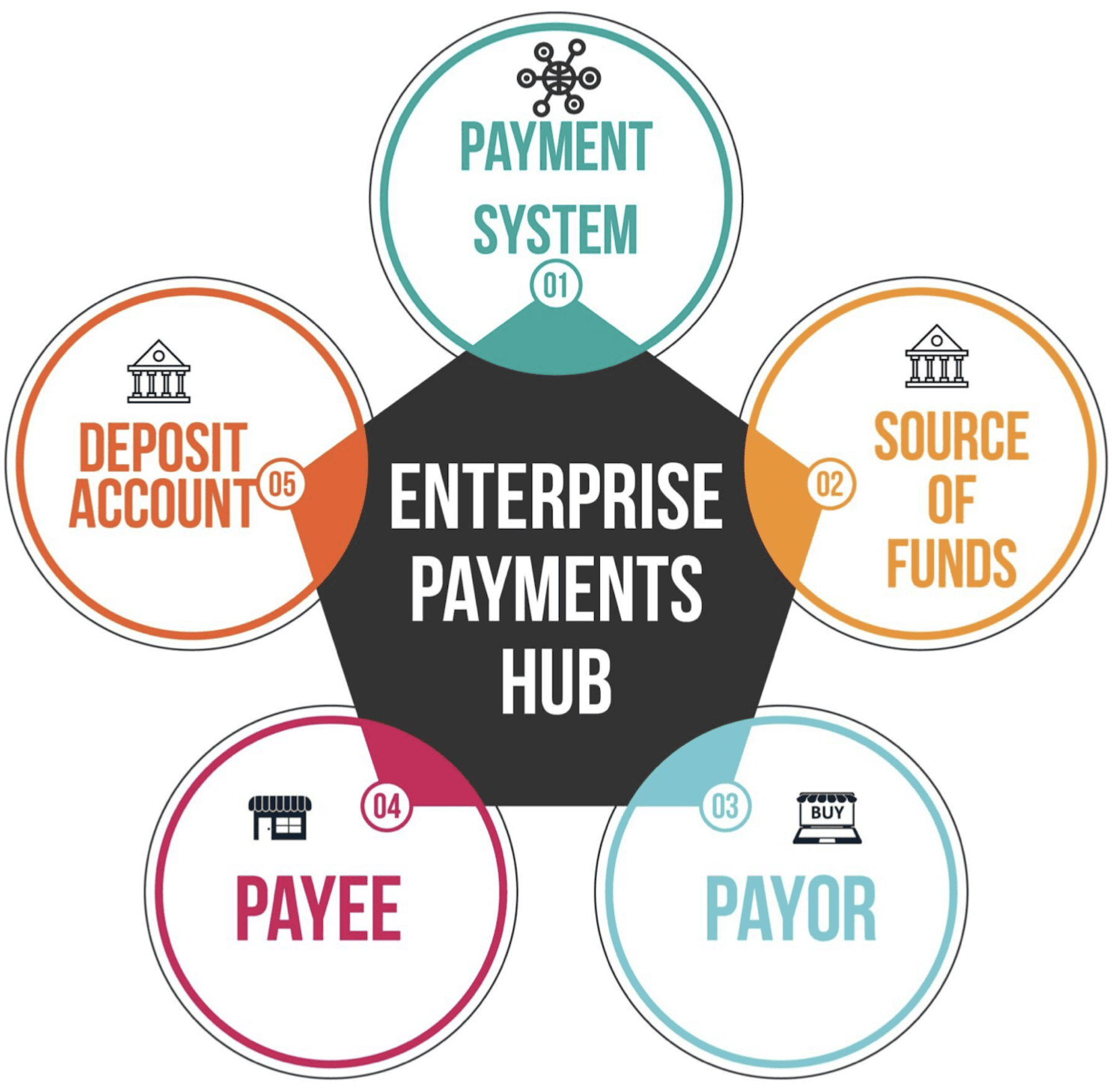

Imagine juggling multiple payment systems, each with its own quirks and complexities. It’s a headache, right? That’s where a payment hub comes into play. A payment hub is a centralized platform that consolidates all your payment operations into one streamlined system. Instead of managing payments through various channels like credit cards, bank transfers, and digital wallets separately, you handle everything from a single interface.

Core Vocabulary

Payment Rails: These are the different methods and networks through which payments are processed. Think of them as the highways for your money—ACH (Automated Clearing House), RTP (Real-Time Payments), and card networks are some common examples.

Centralization: This means combining multiple systems or operations into one unified platform. For payments, it means having all your transactions managed in one place.

Automation: Using technology to perform tasks without human intervention. This increases efficiency and reduces errors.

Compliance: Adhering to laws, regulations, and guidelines set by governing bodies in the financial sector.

Centralizing your payment processes in a single hub simplifies transactions and significantly reduces operational costs. It allows businesses to automate workflows, standardize processes, and ensure compliance with regulatory requirements. For example, Nomentia describes their payment hub as software that gathers data from multiple initiating systems like ERP, banks, treasury, accounting, or financial systems to streamline procedures across various banks and channels.

A well-implemented payment hub offers not just convenience but also enhanced visibility over your transactions. This means better control over funds and reduced risk of fraud or errors—a win-win for any business looking to optimize their financial operations.

Why Your Business Needs a Payment Hub

So why should your business consider adopting a payment hub? Let’s break it down:

Increased Efficiency

When you centralize your payment operations, you save time by eliminating the need to juggle multiple platforms. Everything is managed from one dashboard. This not only reduces errors but also speeds up transaction times significantly. According to Axletree Solutions, implementing a future-ready payment hub can reduce the risk associated with fragmented processes while improving overall operating efficiency.

Cost Reduction

Automating your payment processes lowers operational costs by reducing manual labor and minimizing errors that could lead to costly mistakes. With fewer resources needed for managing payments manually, businesses can allocate their budget more efficiently.

Improved Compliance

Compliance is critical in the financial world. Payment hubs help businesses stay compliant with ever-changing regulations by automating compliance checks and ensuring all transactions meet necessary legal standards. Platforms like Modern Treasury emphasize the importance of complete visibility for every incoming and outgoing transaction to maintain robust compliance measures.

Enhanced Visibility

A unified platform provides better control over transactions by offering real-time insights into where your money is going and coming from. This transparency helps in making informed decisions quickly—an essential feature for any growing business.

Key Features to Look for in Payment Hub Solutions

When choosing a payment hub solution for your business, certain features stand out as essential:

Support for Multiple Payment Methods

Your chosen solution should be versatile enough to handle various payment rails seamlessly—credit cards, bank transfers like ACH or RTP, digital wallets—you name it. The ability to process different types of payments ensures that you can cater to diverse customer preferences without any hiccups.

Automation Capabilities

Automation is key when it comes to streamlining workflows and reducing manual tasks. Look for solutions that offer robust automation features such as automated reconciliation processes or scheduled batch payments (Millennium EBS provides good insights on this). These capabilities free up valuable time so you can focus on more strategic aspects of your business.

Advanced Analytics

Having access to detailed analytics is crucial for making informed decisions about your financial operations (Kyriba highlights this well). Advanced analytics tools within a payment hub can provide insights into transaction patterns, potential risks, and areas where you can optimize costs further.

By understanding what a payment hub is and recognizing its benefits—from increased efficiency to improved compliance—you’re already halfway towards transforming how your business handles transactions. Up next: exploring some top-notch solutions available today!

Top Payment Hub Solutions for Streamlined Transactions

Edge Payment Hub

Edge offers an innovative payment hub solution designed to help businesses streamline their payment operations. It stands out with features like subscription payment management, transaction risk scoring, and QuickBooks integration (coming soon!). These functionalities not only simplify recurring billing but also ensure seamless accounting and mitigate risks associated with transactions.

Key Features: Subscription payment management, QuickBooks integration, transaction risk scoring.

Link: Start Building

Finastra Payment Hubs

Finastra's payment hub is known for its modular design and cloud-native architecture. This solution supports various payment methods and networks, making it flexible for financial institutions looking to innovate in the digital banking space. Finastra's platform emphasizes open finance and can integrate seamlessly with other systems to provide a comprehensive payments solution.

Key Features: Modular design, cloud-native architecture, support for multiple payment methods.

Link: Finastra Payment Hubs

Nomentia Payment Hub

Nomentia focuses on centralizing payment management along with cash flow and treasury processes. Its platform is designed to optimize financial operations by providing robust risk management tools and detailed treasury reporting. Nomentia's flexibility allows customization according to specific business needs, ensuring that all payments are secure and compliant.

Key Features: Centralized payment management, cash flow optimization, risk management.

Link: Nomentia Payment Hub

Finzly Payment Hub

Finzly's Payment Hub aims to unify fragmented payment infrastructures to enhance efficiency and reduce costs. It offers smart payment routing, which helps in selecting the most efficient path for transactions based on various parameters. Additionally, its advanced analytics provide valuable insights that aid in strategic decision-making.

Key Features: Smart payment routing, customizable workflows, advanced analytics.

Link: Finzly Payment Hub

TrustRadius Payment Hubs

TrustRadius provides a comprehensive overview of various payment hub providers through user reviews and product comparisons. It includes detailed descriptions of functionalities offered by different solutions like Kyriba, Blackthorn Payments, and Modern Treasury. This helps businesses make informed decisions based on real user experiences.

Key Features: User reviews, product comparisons, detailed descriptions of functionalities.

Link: TrustRadius Payment Hubs

Axletree Payment Hub

Axletree specializes in automating and integrating global payment processes. Its platform ensures strict compliance with regulatory requirements while providing enhanced visibility over funds through automated workflows. Axletree’s solution supports straight-through processing (STP), minimizing manual intervention.

Key Features: Automation of payment processes, integration capabilities, enhanced visibility.

Link: Axletree Payment Hub

Cobase Payment Hub

Cobase is recognized for its seamless bank connectivity and automated payments system. It integrates smoothly with various ERP systems to offer a unified financial ecosystem that enhances financial management capabilities for businesses of all sizes.

Key Features: Automated payments, seamless bank integration, compatibility with various ERP systems.

Link: Cobase Payment Hub

Infinite Payment Hub

Infinite Computer Solutions offers a versatile payment hub tailored for banks, payment processors, and fintech companies. Its platform consolidates multiple payment methods into one system while providing features like smart routing and tokenization to secure sensitive data.

Key Features: Versatile payment processing, integration of various payment channels,modernized solutions.

By exploring these top-tier solutions from Edge and other major players like Finastra or Nomentia (see more at their respective links), businesses can find the perfect fit tailored to their unique requirements—enhancing efficiency while reducing operational complexities significantly.

In this section:

We delved into eight leading solutions available today.

Provided concise descriptions along with key features.

Included relevant hyperlinks for further exploration by readers interested in specific platforms mentioned above!

Next up—how do you choose which one suits YOUR business best? Stay tuned!

Start Streamlining Your Transactions Today

Choosing the right payment hub can be a game-changer for your business. From increasing efficiency to reducing costs and ensuring compliance, these solutions offer a multitude of benefits that can transform your financial operations. With options like Edge's innovative platform, Finastra's modular design, and Nomentia's focus on centralization, there's a solution out there tailored to meet your unique needs.

Take the first step towards streamlined transactions by exploring these top payment hub solutions. Whether you're looking for advanced analytics, seamless integration with existing systems, or robust automation capabilities, there's something for every business.

For more information or assistance in choosing the right solution, don't hesitate to reach out through our Contact Sales page. Let's streamline those transactions and take your business to the next level!

Frequently Asked Questions

What is a payment hub?

A payment hub is a centralized platform that consolidates all your payment operations into one streamlined system. It allows you to manage various payment methods, like credit cards, bank transfers, and digital wallets, from a single interface. This centralization simplifies transactions, reduces operational costs, and ensures compliance with regulatory requirements.

Why should my business consider using a payment hub?

Using a payment hub can significantly increase efficiency by centralizing your payment operations. It reduces the need for multiple platforms, saves time, and minimizes errors. Automating your payment processes lowers operational costs and improves compliance with financial regulations. Additionally, it provides enhanced visibility and control over your transactions.

What features should I look for in a payment hub solution?

When choosing a payment hub solution, look for support for multiple payment methods to handle various transaction types seamlessly. Automation capabilities are essential for streamlining workflows and reducing manual tasks. Advanced analytics tools are also crucial as they provide valuable insights into transaction patterns and help in making informed decisions.

How do I choose the right payment hub for my business?

To choose the right payment hub for your business, consider factors like scalability—ensure the solution can grow with your business needs. Look at integration capabilities to make sure it can seamlessly connect with your existing systems. Reliable customer support is also vital to address any issues that may arise quickly.

Can you recommend some top-tier payment hub solutions?

Sure! Some of the leading solutions include Edge Payment Hub which offers features like subscription management and QuickBooks integration; Finastra Payment Hubs known for its modular design; Nomentia Payment Hub focusing on centralized management and risk tools; Finzly Payment Hub with smart routing and advanced analytics; TrustRadius providing user reviews of various providers; Axletree Payment Hub specializing in automation; Cobase offering seamless bank integration; and Infinite Payment Hub tailored for banks and fintech companies.

Related Articles

Mastering Payment Gateway Integration: The Essential Guide for Secure Online Transactions - Edge

Unlocking the Best Payment Gateways for E-commerce Success in 2024: A Comprehensive Guide - Edge

Understanding Online Payment Processing: The Ultimate 2024 Guide for Businesses - Edge

Unlocking the Power of Hosted Checkout: A Comprehensive Guide for 2024 - Edge

© 2025 Edge Payment Technologies, Inc.

6600 Sunset Blvd. Ste. 226 Los Angeles, CA. 90028

(323)-388-3931

Registered ISO of FFB Bank and Chesapeake Bank