Unlocking the Power of Hosted Checkout: A Comprehensive Guide for 2024

Simplify online payments with hosted checkout solutions. Enhance security, ease compliance, and boost customer trust. Learn more and improve your e-commerce today!

Hosted checkout is a payment processing solution that allows businesses to manage their online transactions through a third-party service. This method is particularly beneficial for e-commerce businesses, as it simplifies the payment process, enhances security, and reduces the burden of compliance with payment regulations. In this article, we will explore the concept of hosted checkout, its advantages and disadvantages, and how it compares to non-hosted payment solutions. We will also look at major players in the field and provide resources for further reading.

Key Takeaways

Enhanced Security and Simplified Compliance: Hosted checkout solutions offer robust security features and ease compliance with PCI standards.

Ease of Implementation: These solutions are generally easier and quicker to set up compared to in-house payment systems.

Trade-offs in Control and Data: While offering benefits, hosted checkout solutions can limit control over the user experience and access to customer data.

What is Hosted Checkout?

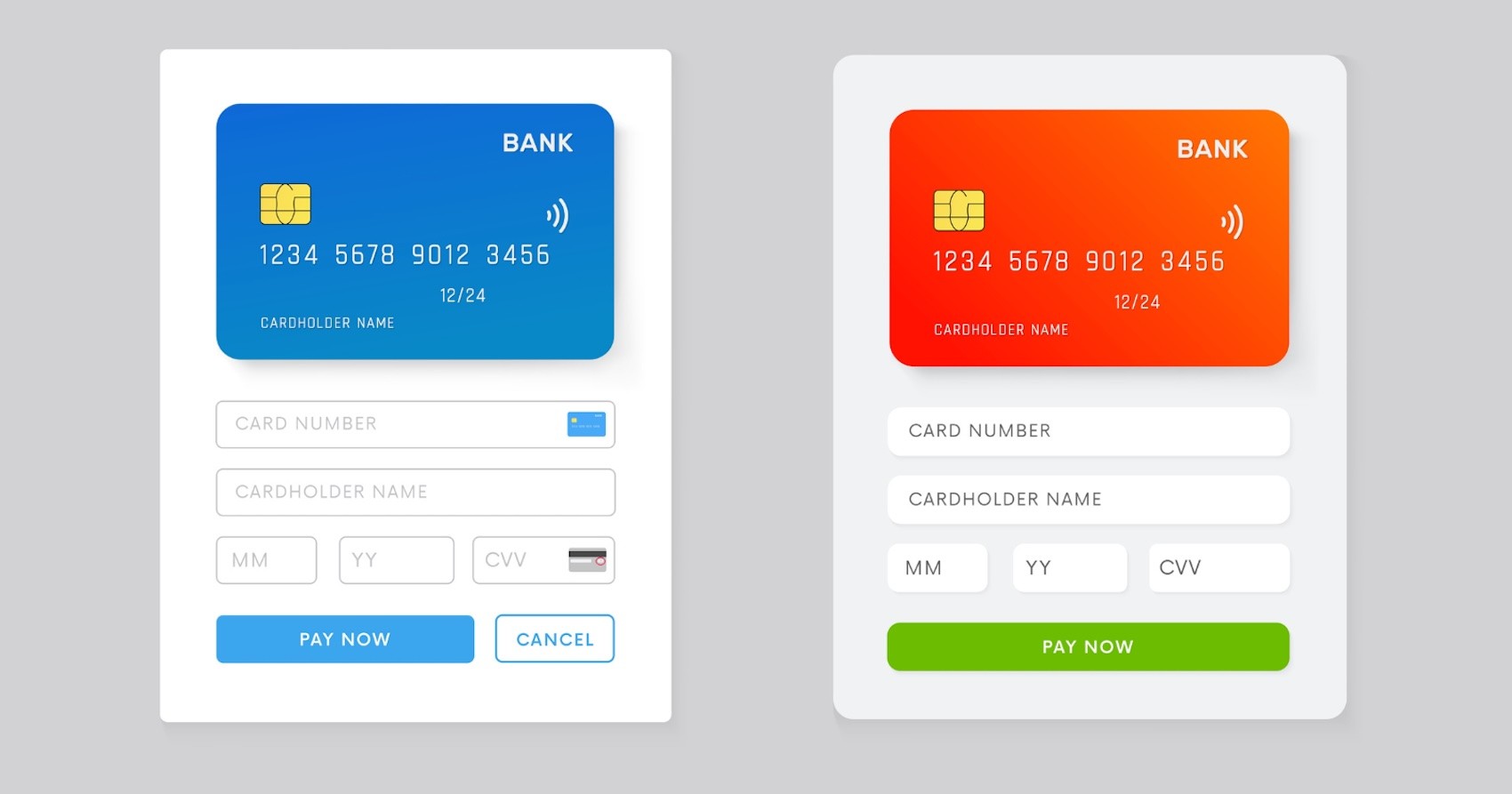

Hosted checkout refers to a payment processing system where the checkout page is hosted on a third-party server rather than the merchant's website. When a customer is ready to make a purchase, they are redirected to the hosted checkout page, where they can enter their payment information. This process is managed by a payment service provider (PSP), which handles the transaction securely.

Key Vocabulary

Payment Service Provider (PSP): A company that offers online payment processing services to businesses, allowing them to accept payments via credit cards, debit cards, and other methods.

PCI Compliance: The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment.

Hosted Payment Page (HPP): A secure web form provided by a PSP that handles electronic transactions, allowing businesses to accept payments without storing sensitive customer data.

Advantages of Hosted Checkout

Enhanced Security: Since the payment information is processed on a third-party server, businesses do not have to store sensitive data, reducing the risk of data breaches and fraud.

Simplified Compliance: Hosted checkout solutions often come with built-in compliance features, making it easier for businesses to adhere to PCI standards.

Easy Setup: Implementing a hosted checkout solution is generally quicker and requires less technical expertise compared to building an in-house payment processing system.

Customer Trust: Many customers feel more secure entering their payment information on a well-known third-party site, which can lead to higher conversion rates.

Disadvantages of Hosted Checkout

Limited Control: Businesses have less control over the checkout experience, which can affect branding and customer engagement.

Redirecting Customers: Redirecting customers to a third-party site can create trust issues, as some may hesitate to leave the merchant's website.

Data Collection Limitations: Businesses may have limited access to customer data collected during the checkout process, which can hinder marketing efforts.

Comparison with Non-Hosted Payment Solutions

Hosted Payment Gateways: These redirect customers to a third-party payment service provider's page to complete transactions. They offer enhanced security and are easy to set up but can create trust issues for customers.

Non-Hosted Payment Gateways: These allow customers to enter payment information directly on the merchant's website, providing a seamless experience that can enhance trust and potentially improve conversion rates. Merchants maintain full control over the checkout process and can better track customer data for future marketing.

For a more detailed comparison, you can refer to this comprehensive comparison between hosted and self-hosted checkout solutions.

Major Players in the Hosted Checkout Field

Stripe: Offers a low-code payment integration solution that allows businesses to create customizable payment forms. Stripe Checkout can be embedded directly on a website or hosted on Stripe's platform.

Clover: Provides a hosted checkout feature that allows customers to pay for orders directly on a merchant's website, making it suitable for businesses without physical payment terminals.

Verifone: Offers a range of payment solutions, including hosted checkout options, designed to enhance payment processing for businesses of all sizes.

Finix: Provides a comprehensive payment solution that includes a hosted checkout page, automated merchant underwriting, and compliance management.

Implementation Steps for Hosted Checkout

Step 1: Choose a Payment Service Provider (PSP)

Selecting the right PSP is crucial. Consider factors such as transaction fees, security features, ease of integration, and customer support. Popular PSPs like Stripe, Clover, Verifone, and Finix offer reliable hosted checkout solutions.

Step 2: Set Up Your Account

Once you've chosen a PSP, sign up for an account. This usually involves providing your business details, banking information, and completing any necessary verification processes.

Step 3: Customize Your Checkout Page

Most PSPs allow you to customize the hosted checkout page to match your branding. You can add your logo, choose colors, and configure the fields that customers need to fill out.

Step 4: Integrate with Your Website

Integrating the hosted checkout solution with your website typically involves adding a few lines of code. The PSP will provide detailed instructions and support to help you through this process.

Step 5: Test the Checkout Process

Before going live, thoroughly test the checkout process to ensure everything works smoothly. This includes testing different payment methods and ensuring that transactions are processed correctly.

Step 6: Go Live

Once you're confident that everything is set up correctly, you can go live with your hosted checkout solution. Monitor the initial transactions closely to catch any potential issues early on.

For more detailed guidance on setting up hosted checkout solutions, check out this article.

Best Practices for Using Hosted Checkout

Optimize for Mobile

Ensure that your hosted checkout page is mobile-friendly. Many customers shop on their mobile devices, and a seamless mobile experience can significantly boost your conversion rates.

Keep It Simple

A cluttered checkout page can overwhelm customers and lead to abandoned carts. Keep the checkout process as simple and straightforward as possible, asking only for essential information.

Offer Multiple Payment Options

Different customers prefer different payment methods. Offering a variety of payment options, such as credit cards, debit cards, PayPal, and digital wallets, can cater to a broader audience.

Communicate Clearly

Provide clear instructions and reassure customers about the security of their transactions. Displaying security badges and a concise privacy policy can help build trust.

Monitor and Optimize

Regularly review your checkout process and look for areas of improvement. Use analytics to track conversion rates and identify any bottlenecks or issues that need to be addressed.

FAQs about Hosted Checkout

What is hosted checkout, and how does it work?

Hosted checkout is a payment processing system where the checkout page is hosted on a third-party server. When a customer is ready to make a purchase, they are redirected to this hosted page to enter their payment information. The transaction is managed securely by a payment service provider (PSP).

What are the advantages and disadvantages of using a hosted checkout solution?

Advantages:

Enhanced security

Simplified compliance

Easy setup

Increased customer trust

Disadvantages:

Limited control over the checkout experience

Potential trust issues due to redirection

Limited access to customer data

How does hosted checkout compare to non-hosted payment gateways?

Hosted checkout gateways redirect customers to a third-party site, offering enhanced security and ease of setup. Non-hosted gateways allow customers to enter payment information directly on the merchant's website, providing a seamless experience and better control over customer data.

Who are the major players in the hosted checkout field, and what services do they offer?

Major players include Stripe, Clover, Verifone, and Finix. They offer services such as customizable payment forms, mobile-friendly checkout pages, and comprehensive payment solutions with built-in compliance features.

What specific factors should businesses consider when choosing a hosted checkout provider?

Businesses should consider transaction fees, security features, ease of integration, customer support, and the ability to customize the checkout page to match their branding.

How do different industries utilize hosted checkout solutions?

Different industries utilize hosted checkout solutions based on their specific needs. For example, e-commerce businesses may prioritize ease of integration and mobile optimization, while subscription services may focus on recurring billing features.

What are the long-term implications of using hosted checkout for customer data management and marketing strategies?

Using hosted checkout can limit access to customer data, which may affect marketing strategies. However, it also reduces the risk of data breaches and simplifies compliance with data security standards.

Related Articles

Hosted Checkout Solutions: An Overview of What Hosted Checkout Is and How It Works

Hosted Checkout Solutions and How They Can Expedite the Setup Process for New Businesses

A Comprehensive Comparison Between Hosted and Self-Hosted Checkout Solutions

A Guide to Resolving Common Problems with Hosted Checkout Solutions

By understanding hosted checkout and its implications, businesses can make informed decisions about their payment processing strategies, ultimately enhancing the customer experience and improving transaction success.

© 2025 Edge Payment Technologies, Inc.